In Detroit, businesses will soon face choice: Accept cash or risk misdemeanor

Detroit businesses that refuse to accept cash payments after Sept. 11 could face a fine and possible misdemeanor charges under a new ordinance passed by the City Council.

Council Member Angela Whitfield-Calloway, who sponsored the law change, said there’s few businesses that only accept debit or credit cards but she wants to prevent unbanked residents from being left behind as digital transactions become more popular. Residents who support the ban said cashless establishments discriminate against residents who can’t afford to get a credit card or lack access to a bank.

“Most of the businesses in Detroit are already in compliance,” Whitfield-Calloway told BridgeDetroit in an interview. “It’s just a handful of businesses that don’t accept cash and we’re hoping that it doesn’t become widespread.”

Related:

- Detroit leaders mobilize gun violence response as shootings rise

- If you want to make $100,000 a year as a teacher, here’s where you should apply

- Duggan urges state Legislature to fix Detroit’s ‘unfair’ tax system

Council voted 9-0 to unanimously approve the ordinance Tuesday. At least two dozen residents voiced support for the ban during a Monday public hearing and Tuesday’s formal session.

“The COVID crisis was a global pandemic, that’s the reason why everyone embraced going cashless at the time, but that is no reason to continue to support a system that segregates and discriminates openly,” said Richard Clay, a board member of the National Federation of the Blind Detroit chapter. “I know a lot of line people and a lot of disabled people who just outright prefer to deal with cash and don’t feel that they have the access to cards.”

Whitfield-Calloway said the ordinance was born from an experience last October, when she was unable to buy lunch at the Plum Market downtown with a $20 bill. The incident inspired the councilwoman to start researching the spread of cashless businesses across the country and impact on residents who prefer to deal with cash.

“If it happened to me, how many others is that happening to, and do I want this trend to tick up and become commonplace in the City of Detroit?” Whitfield-Calloway. “I said ‘no, it would be the wrong course of business’ … Until now, a lot of people weren’t talking about unbanked and underbanked (people), but we know that there is a population in this city where people simply just do not have bank accounts.”

Cash payments have been declining at a steady pace over the last several years, according to data from the Federal Reserve, dropping from 31% of all transactions in 2016 to 18% by 2022. The shift is happening faster for younger people since the COVID-19 pandemic; cash use dropped 20% among 18 to 24 year olds from 2019 and 2022.

Income has a major impact on how consumers pay for things. More than 90% of the unbanked population live in households making less than $75,000. Detroit’s median household income is $34,726.

Federal data shows nearly 8% of households are unbanked in the Detroit metro area, which includes Wayne, Oakland, Macomb, Livingston and Lapeer counties. Roughly 5% of Michigan households don’t have access to a bank, while 21% of Black residents are unbanked.

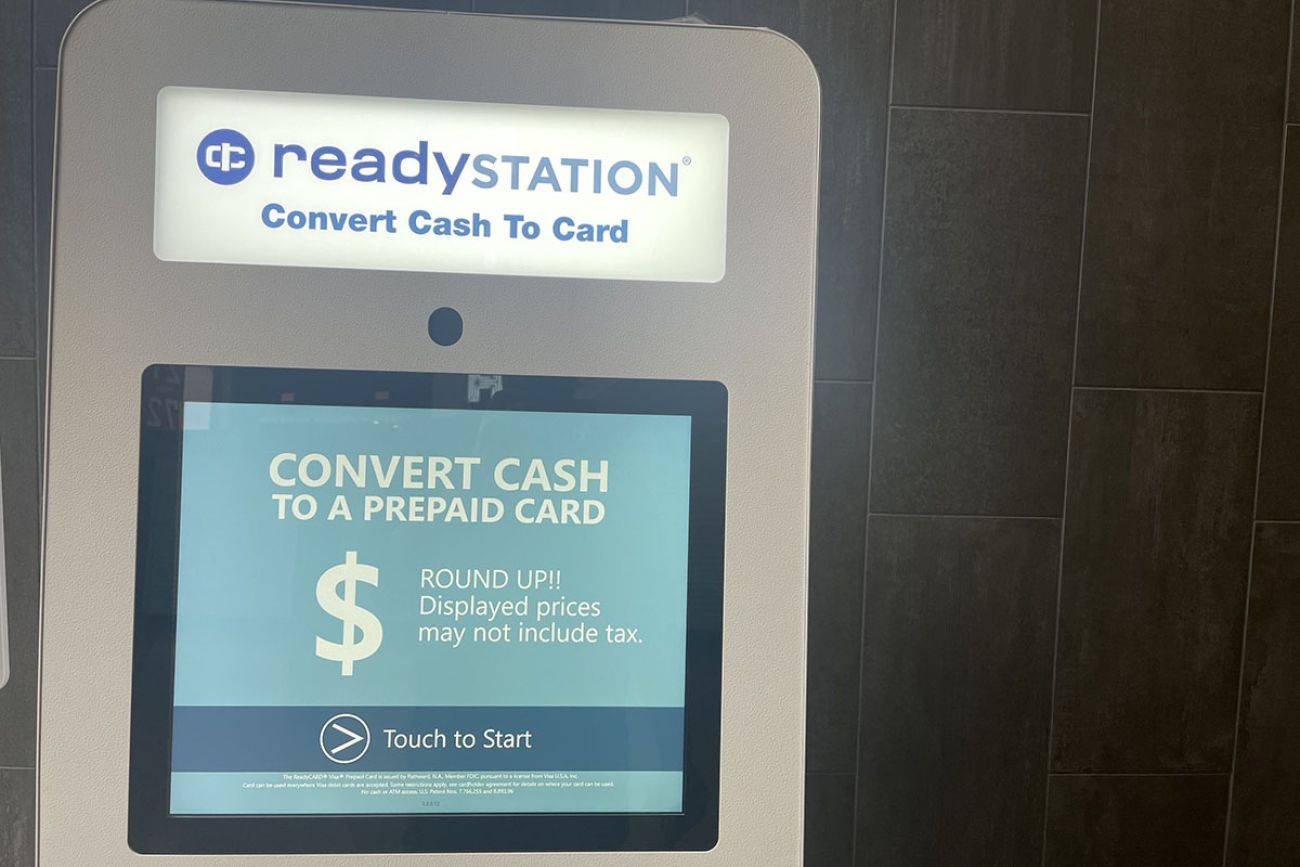

Whitfield-Calloway said she only knows of four businesses that do not accept cash: Plum Market, Comerica Park, Ford Field and Little Caesars Arena. The downtown arenas offer machines that allow visitors to transfer cash onto a card. BridgeDetroit visited LCA on Monday and found the machine does not charge a fee or require a minimum transaction amount.

That doesn’t include Danielle North, owner of Kidz Kingdom, a childcare center and birthday party venue. North said she switched to cashless transactions in 2019 for safety reasons; she has an all-women staff and doesn’t want to be a target of theft.

“No one should be criminally charged for not accepting cash, that’s just so extreme,” North said in an interview. “There are other reasons why a business can be cashless. There’s a separate issue of educating the community on becoming banked. There has to be like a middle ground or a healthy balance between businesses being fair to their consumers and also businesses being able to properly and effectively manage their business.”

Charity Dean, president and CEO of the Metro Detroit Black Business Alliance, added that the ordinance doesn’t do anything to help residents get access to a bank. Dean urged council to reject the ban, saying small business owners should not be penalized for shifting to contactless payment options during the pandemic.

“When I was director of Detroit’s Department of Civil Rights, Inclusion and Opportunity, I led the small business response to COVID,” Dean said in an interview. “We did webinars and talked to people about how to convert their business to contactless. The City of Detroit paid for this in the summer of 2020. Now, in the summer of 2023, we decide we want to ban businesses that are doing the thing we trained them to do? It doesn’t make sense.”

Violating the ordinance could result in a misdemeanor, $500 fine and up to 90 days in jail. However, Whitfield-Calloway said she received assurances from 36th District Court Chief Judge William McConico that fines would not exceed $175.

“Nobody’s going to be thrown in jail,” Whitfield-Calloway told BridgeDetroit after the vote.

Assistant Corporation Counsel Graham Anderson said it’s not possible to penalize violators with a civil infraction; a misdemeanor is the lowest level penalty available under the law. Anderson said the goal is not to criminalize business owners. He said the Law Department will use discretion in enforcing the ordinance, and businesses would likely get a warning before being charged.

“I’m also very confident there’s not a judge in 36th District Court that would be enthusiastic about throwing anyone in jail for 90 days for violating this ordinance,” Anderson said.

Regardless, Dean said the misdemeanor penalty is excessive and her organization won’t ever support anything “that is going to give someone a misdemeanor for operating their business.”

“(Whitfield-Calloway) went to Plum Market and couldn’t buy a sandwich,” Dean said, “and because of that all of these businesses will have to suffer with misdemeanors as a penalty.”

The ordinance will only apply to retail and food establishments, which includes food trucks. Exceptions are made for parking lots and garages, rideshare services, establishments that offer free conversion of cash onto a card, wholesale clubs, retailers who sell goods through a membership and transactions over the phone, mail or internet. The ordinance doesn’t require businesses to accept bills worth $100 or more.

Whitfield-Calloway said the ordinance doesn’t apply to pop-up businesses. Council President Pro Tem James Tate pressed the Law Department on how it would affect home-based businesses, and was told the ordinance will not apply to those businesses, either.

The Federal Reserve found few people expect to stop using cash in the future. A survey found 70% of consumers believe a completely cashless society would be problematic and 3% of participants think they’ll stop using cash in the next five years.

Business Watch

Covering the intersection of business and policy, and informing Michigan employers and workers on the long road back from coronavirus.

- About Business Watch

- Subscribe

- Share tips and questions with Bridge Business Editor Paula Gardner

Thanks to our Business Watch sponsors.

Support Bridge's nonprofit civic journalism. Donate today.

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!