District Detroit developers want half of cost covered by public financing

Developers behind the $1.5 billion “District Detroit” project are asking state and local officials to subsidize roughly half of the cost through taxpayer-funded loans and tax cuts.

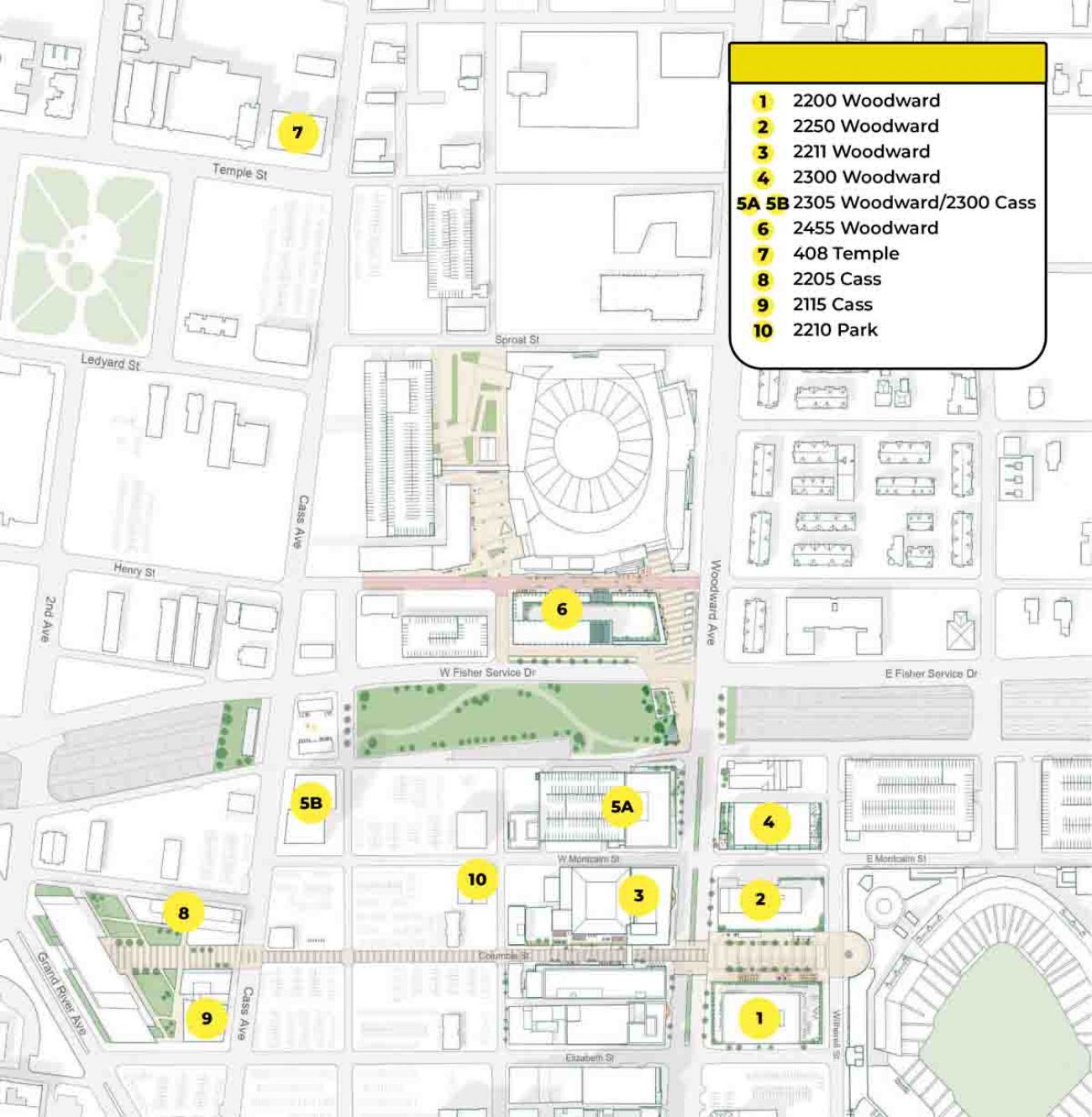

Residents who live near the proposed slate of 10 developments on the north end of downtown heard the details during a Tuesday night meeting of the project’s Neighborhood Advisory Council. While the development team – the Illitch family’s Olympia Development and Stephen Ross’ Related Cos. – will seek $797 million through multiple loan and tax cut programs, the city expects to collect $751 million in property taxes over the next 35 years. Representatives with the Detroit Economic Growth Corp. (DEGC) posed the tradeoff as “all upside for the city.”

“Incentives are only granted when there’s a net benefit,” said DEGC Executive Vice President Kenyetta Hairston-Bridges. “If at any point in time the developer does not follow through on these commitments, the City Council has the right to go to the state and ask to rescind the abatements. All tax abatements are governed by a legal agreement, and the city will never lose money on a tax abatement. The project will not receive the benefit of the tax abatement until they are totally constructed.”

Related:

Most of the financing would come from a $616 million transformational brownfield plan, which needs approval from the Michigan Strategic Fund, Detroit City Council and the city’s Brownfield Redevelopment Authority. The program allows large-scale projects to have a portion of construction costs reimbursed through taxes collected from the project over 35 years.

Developers are also seeking to reduce property tax bills through a $96 million tax abatement for commercial properties and $37 million tax abatement for residential properties, which both require approval from the DEGC and City Council. Another $48 million in two loans were approved Wednesday by the city’s Downtown Development Authority, including a new loan program aimed at subsidizing “deeply affordable” housing.

Members of the DDA debated whether to award the loan to Olympia and Related Cos., with some arguing that a $23.7 million loan would exhaust available funding that could be used for other projects.

“I support housing, and I support infrastructure but I cannot support ($23.7 million) being given to one entity when there are so many needs for the continuation of redevelopment and property of this entire downtown,” said DDA member Marvin Beatty. “It’s too goddamn much money, too much tax money.”

Another $25 million loan to reimburse infrastructure construction was less controversial. Both loans were ultimately approved by the DDA. Wednesday’s vote came a day after Mayor Mike Duggan announced the loan program, and said District Detroit would be its first recipient.

The amount of financial help is “hard to wrap your head around,” said Francis Grunow, a frequent attendee at District Detroit meetings. Grunow is a Detroit resident who served on a now-disbanded neighborhood advisory board during the Illitch family’s construction of Little Caesars Arena.

“It just kind of underscores the need to really think about our taxing regime overall,” Grunow said. “It’s bigger than a district or Detroit, even. Is this the only way that we can do this kind of stuff? It just doesn’t seem sustainable.”

Nevan Shokar, associate director for special projects at DEGC, said the incentives don’t go too far. He argued the District Detroit developers wouldn’t be able to attract investors for the project or secure bank loans without the help.

“The big question is: Could this project happen without incentives?” Shokar said during the Tuesday night meeting. “No, this project would not happen without incentives.”

DEGC representatives said the tax breaks will result in a long-term boon for the city’s tax revenues. Annual revenue from the properties today is only $249,000 per year; that would increase to $21 million annually after 35 years. The DDA would receive a net benefit of $375 million to use on future projects as well, according to the Tuesday night presentation.

If all the pieces fall into place, the developers could have roughly 53% of the development cost covered through loans and tax cuts. However, all of the incentives are contingent on the projects being finished. Developers have a sprawling vision for the area, with plans for four residential buildings, four commercial offices, two hotels, on-site parking and public space enhancements. They plan to finish it all by 2028.

Overall, the projects are expected to create 1.2 million square feet of commercial office space and 146,000 square feet of retail space, along with 467 hotel rooms and 695 residential units.

Developers hyped dramatic changes for the area, displaying design renderings that promise bustling street corners and connected neighborhoods in the place of surface parking lots. Rian English Barnhill, vice president of government and community affairs for Olymipa, said the goal is “keeping the soul of Detroit” that represents a population that is majority-Black and working class.

“We want this to be a downtown for everyone,” English Barnhill said. “We want to make sure the folks who have stayed through every economic downturn have a place to take part in all the excitement.”

One-fifth of the housing units would be offered at reduced rates that are affordable for a two-person household earning $35,800 or less. Those 139 units would be affordable for people earning $16 an hour, Hairston-Bridges said.

“Our low-income residents in the City of Detroit will be able to live in downtown Detroit – where many of them work – and they will be able to join in the same amenities as the market rate units in this development,” Hairson-Bridges said.

Duggan said the new loan program was created to prevent low- and middle-income Detroiters from being priced out of downtown housing. Only offering market-rate units creates “a bastion of wealthy folks in one area,” Duggan said, and contributes to economic and racial segregation.

“I believe Detroit is a place where the doctor who works at Henry Ford Hospital should be able to be in the same neighborhood as the Henry Ford Hospital workers in the cafeteria,” Duggan said at Tuesday’s Detroit Policy Conference. “That’s what a city is about. It’s people of different incomes and different backgrounds living together.”

The new DDA financing tool offers loans for projects where at least one-fifth of housing units are reserved for people earning between 50% and 70% of the median income for Wayne County. That’s between $31,350 and $43,890 for one person.

Portions of the loans could be forgiven if developers rent the units to people who have lived in Detroit for at least three years. Duggan says it’s a measure to give preference to Detroiters.

“We don’t just want to preserve the affordable housing, we want to build it,” Duggan said.

Housing affordability is based on the area median income for Wayne County, not the city of Detroit. Census data shows the median income for Detroiters is $18,000 less. Grunow said targeting rental rates at 50% of the area median income helps make up some of the difference.

“Having the deepest amount of affordability is a good thing, but at what cost?” Grunow said. “It’s an incredible cost.”

Duggan said Detroit can attract new residents while protecting those who have lived here much longer and are worried about being priced out.

“You see a number of these cities where they did not plan for the impact of gentrification,” Duggan said. “You start to bring in these kinds of jobs and housing costs go through the roof. There is a growing confidence that there’s a city in the country that can welcome new people, while still watching out for those who’ve been here.”

Another major question surrounding District Detroit is whether more office space is needed in downtown Detroit. Since the COVID-19 pandemic, average daily workers downtown slid by 68%, according to data presented at Tuesday’s policy conference

Eric Larson, CEO of the nonprofit Downtown Detroit Partnership, said he doesn’t expect workers will be in the office five days a week as they did before the pandemic. Duggan said employers are using less space but companies still believe that in-person work is essential to their culture.

“It’s not like Stephen Ross doesn’t know what he’s doing when it comes to building offices,” Duggan said. “Why is he building on the space? Because he believes when you add the University of Michigan grad school down the street, that Detroit is going to be a very desirable place for national and international companies.”

Business Watch

Covering the intersection of business and policy, and informing Michigan employers and workers on the long road back from coronavirus.

- About Business Watch

- Subscribe

- Share tips and questions with Bridge Business Editor Paula Gardner

Thanks to our Business Watch sponsors.

Support Bridge's nonprofit civic journalism. Donate today.

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!