Michigan workforce quietly passes pre-pandemic levels, shows resilience

- Michigan’s labor market is rebounding and the workforce is larger than before the pandemic

- The gain in labor force participation should bolster the state’s economy as the nation’s growth slows

- Still, inflation persists here and across the U.S.. and how it affects consumer spending will be telling for the economy in 2024

Quietly, Michigan has passed an important milestone in its long climb from pandemic job losses.

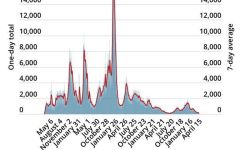

There are now more people working in Michigan than there were in late 2019 — in the months before COVID-19 prompted waves of job losses and workers began to flee the labor force.

In October, 61.8 percent of working-age Michiganders held jobs, up 0.1 percentage points from the same month in 2019. In raw numbers, 4,806,000 people were employed last month, a rise of 24,000 jobs over October 2019.

Related:

- Michigan is spending to fill critical worker gaps. Here’s what’s needed

- Michigan public companies having a rockier year than overall stock market

- Ford and GM answer Wall Street questions about when EVs will be profitable

- Robust jobs market in January suggests economy not ‘cooling’ as predicted

The new job numbers represent a massive increase when compared to the height of pandemic shutdowns: There are now 1.26 million more filled jobs in Michigan than in April 2020, when companies and schools shuttered as the deadly virus spread.

Labor force participation “has come back in a big way this year,” said Gabriel Ehrlich, director of the Research Seminar in Quantitative Economics at the University of Michigan.

High employment levels are a boon for workers and, importantly, suggest the state is in a better position to weather an economic downturn than much of the country, according to a forecast Ehrlich and other U-M economists issued this month.

But the market presents a continuing challenge for businesses. The state's 4.1 percent unemployment rate in November is lower than a year earlier and many businesses continue to struggle with staffing. And data suggests the era of tight labor markets “is here to stay in Michigan,” Ehrlich told Bridge Michigan.

The state’s relative labor market strength — alongside continued job growth — comes as the U.S. economy shows signs of slowing amid higher interest rates and diminished spending power and personal savings.

Job growth in Michigan climbed 3.9 percent in 2022 as the state continued its recovery from pandemic closures and supply chain constraints. It reached a more typical 1.5 percent growth so far this year, and the U–M economists expect 0.9 percent growth in the next two years.

Nationally, slowing job gains are expected through 2025, but monthly gains should never dip below 60,000 jobs, U-M economists said. The economy is likely to add 1.7 million jobs nationally in 2024 and 1 million in 2025.

If in fact Michigan’s workforce proves resilient in the event of a downturn, that would represent a turning point for the state’s economy, which in the past has been more vulnerable to recessions than other states, driven in part by the state’s heavy reliance on the auto industry.

Increasing industry diversification — particularly in west Michigan, where the health-care industry and tourism complement manufacturing — gives the state more of a cushion against economic headwinds, said Paul Isely, associate dean and professor of economics at Grand Valley State University.

That, along with Michigan businesses’ ongoing struggles to keep pace with staffing needs, should prevent the state from experiencing severe consequences from a national slowdown, even one that moves into a mild recession.

“Even with a massive slowdown in the economy, we still don't have enough workers,” Isely said.

“We could have every marker for a recession except for unemployment,” he said, so “you’re not going to see that bump in unemployment that you normally expect.”

National factors

Despite the encouraging forecast, U-M economists said the state is “not out of the woods yet.”

“Even though our baseline forecast for Michigan is relatively optimistic,” they wrote,”it is important to recognize that the state's economic trajectory can be significantly influenced by the broader national economic outlook.”

Despite fears of a recession this year, the national economy remained stronger than expected.

But the pace of growth is likely to slow in the next several quarters, the U-M report said, as “high interest rates bite” into growth.

By 2025, the U.S. will grow at a 2 percent annualized rate, the U-M economists predict, after the Federal Reserve turns to lowering the federal fund rates. They expect that to happen in late 2024, in turn spurring a reduction in consumer interest rates.

The move may help with housing inflation; hikes since 2021 have doubled the borrowing costs on homes, even as prices increase.

Interest rates for a 30-year mortgage are expected to fall from a national average of 7.5 percent at the end of this year to 7.1 percent early in 2024, according to the Mortgage Bankers Association’s November outlook. Every quarter next year should bring decline, the MBA said, sliding to 6.6 percent in the second quarter, and finishing the year at 6.1 percent.

However, median home prices aren’t on the same path. Existing home sale prices in the U.S. peaked at $401,400 in the third quarter, and are likely to drop to $397,100 by year-end. But the MBA said median prices will climb slightly in early 2024 before falling by about $4,000 in the second half of next year.

Borrowing costs — and the United Auto Workers strike against the Detroit Three this fall — slowed national light vehicle sales, which were on track to reach about 15.5 million this year. Lower interest rates are expected to boost sales next year.

Consumers feel the stress

Isely, the Grand Valley economist, is keeping his focus on consumer behavior as he looks for signs of the economy’s next turn. National consumer sentiment dropped this fall, even as people continue to spend money that fuels economic growth.

Until this year, people continued to spend money accumulated during the pandemic from federal stimulus funds, unemployment benefits and household savings (such as lower transportation costs as more people worked remotely).

Isley said Americans now have less disposable income due to inflation. In addition, borrowers face higher interest rates for houses, vehicles and credit card debt and millions of people are again paying off student loan debt.

As a result, Isely said, “consumers are starting to buy less stuff. They have less money to buy stuff. The interest rates have gone up making it hard to borrow money to buy stuff.”

The ripple effect leads to factory orders, he said, “because if they're buying less stuff factories have to make less.”

For individuals, household savings — the most liquid part of wealth — are below what they were in 2018.

“That tells us they’re spending faster than they’re earning,” Isely said.

Michigan’s personal income per capita is expected to climb to $63,800 in 2025, after gaining 4.1 percent this year and 3.2 percent in 2024. The amount is roughly 30 percent higher than in 2019.

But due to high inflation, real disposable income per capita will take “a small step back” in 2024 before growing at a 1 percent pace in 2025, the U-M report said.

Business Watch

Covering the intersection of business and policy, and informing Michigan employers and workers on the long road back from coronavirus.

- About Business Watch

- Subscribe

- Share tips and questions with Bridge Business Editor Paula Gardner

Thanks to our Business Watch sponsors.

Support Bridge's nonprofit civic journalism. Donate today.

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!