Mining’s last stand? A UP way of life is threatened

MARQUETTE COUNTY – At Sherri's Restaurant in Ishpeming, above the faint clatter of dishes from the kitchen, the conversation of the day in winter skips around from town gossip to snowmobiling to the latest storm to close the local schools. As one might expect in a no-frills Upper Peninsula diner, the food is all-American, the portions ample.

Says owner Sherri Steele of the “farmers' omelette” on the breakfast menu, a calorie-rich platter of three eggs, green pepper, onion, cheese, potatoes and toast on the side: “It's huge.”

But as she prepared for the Friday night smelt fish fry she'll dish up that evening, Steele touched on another topic that looms over this community: What if the mines close?

“I'd say at least a quarter, maybe half, of my business is miners,” Steele said. “Any job is important in the UP. If they closed, we would all really feel it.”

After all, this is iron ore country and the two yawning open-pit mines a few miles southeast might as well be on the endangered species list. They are the UP's last remaining iron ore mines.

Between them, the Tilden and Empire mines west of Marquette issue paychecks to about 1,050 union workers. They labor for generous blue-collar benefits and wages – some grossing upwards of $90,000 a year – jobs that are all but irreplaceable in this hardscrabble country. But as negotiations for a new labor contract drag on, the operation looks to be hanging by a thread, as a retreating Chinese economy and cheap foreign steel have dropped the bottom out of the market.

Mining against the wall

A mile wide and 1,200 feet deep, the 52-year-old Empire mine is already on borrowed time.

Confirming earlier announcements, Lourenco Goncalves, CEO of Cleveland-based Cliffs Natural Resources – the mines' majority owner - said in late January the mine will close sometime this year.

That will likely cost several hundred jobs, though company officials declined to say how many. The mine employs about 350 union workers. The firm has already idled two of its three Minnesota iron mines.

If the market for ore rebounds, the younger, adjacent Tilden mine could have another couple decades.

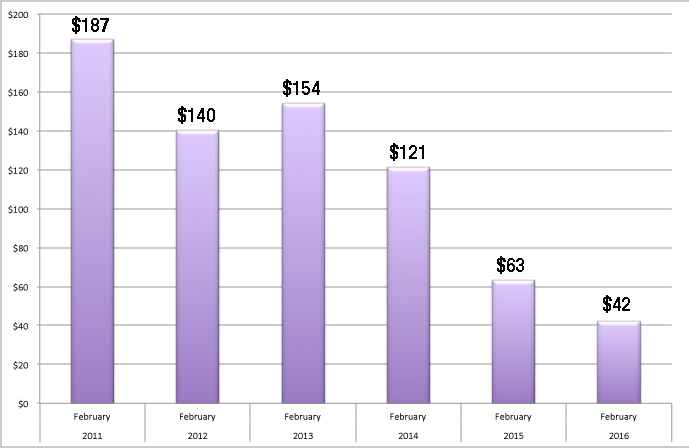

But that might be less than a sure bet, given the steep drop in the price of ore, from nearly $190 a metric ton in February 2011 to less than $40 in December 2015. It's already claimed mining operations in western Australia, which shut down in February at the cost of 4,000 jobs. The value of ore is projected to hover around $40 a ton in 2016, with expectations more mines will be put out of business.

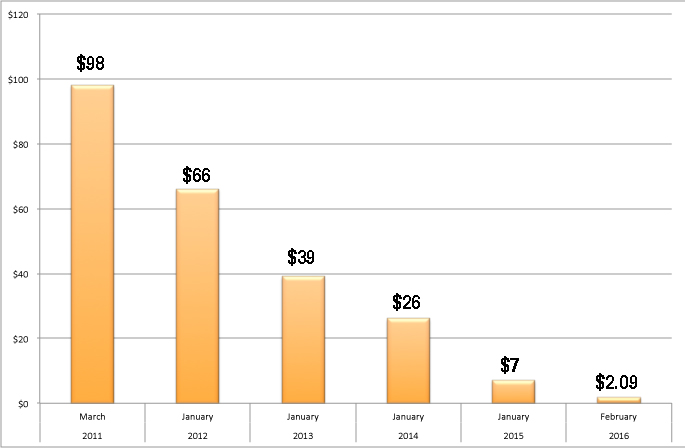

More ominously, the stock value of the Cliffs has been in freefall, tumbling from more than $98 a share in March 2011 to about $2 a share in recent stock postings.

More coverage: From Italy to the UP: One family's mining history

One expert on the industry said the firm's survival could be up in the air.

“That's the $64,000 question,” said Garrett Nelson, who analyzes the metals and mining industry for BB&T Capital Markets in Virginia.

Nelson credits the firm with trimming the scope of its operations to focus on its Minnesota and Michigan ore mines, noting the recent sale of its last remaining coal mines in West Virginia and Alabama.

He said Cliffs still makes money on ore it ships, fetching about $77 a ton in its last quarter. That's because it can be too expensive for foreign producers to ship ore for U.S. steel production.

But like other North American producers, Cliffs has been facing downward pressure on ore prices from the import of cheap foreign steel from Asia. That undercuts U.S. steel production. And Nelson said Cliffs is further weighed down by debt from its ill-timed $4.3 billion purchase in 2011 of a Quebec ore operation – when ore was at $190 a ton – that it unloaded in December 2015 for $10.5 million and the assumption of $42 million in environment debt.

“They are doing whatever they can to stay afloat,” Nelson said. “They are making the right moves, but there's only so much that can be done without a real improvement in domestic ore demand.”

Industry as identity

To Michigan residents who live in the cities of the Lower Peninsula, these might seem like the distant concerns of some foreign land. But up here, to paraphrase Vince Lombardi, mining is not everything – to some, it's about the only thing.

Peter Frustaglio Jr., 41, is the fourth generation (see accompanying story) in his family to mine ore. A diesel mechanic, he earns about $27 an hour.

Grasping the edge of his kitchen table after work one afternoon, he tells a visitor he lives close enough to the mines that he can feel the rumble each day about noon, when explosive charges are set off to crack open layers of rock at the bottom of the pit.

He says there's talk “every day, all day long” in the mines about what might happen.

“It's not good talk. It's scary. This is pretty much a one-horse town,” Frustaglio said.

In nearby Negaunee, at Paul's Barber Shop, barber Paul Remillard, 78, has been cutting the hair of miners and retired miners for 55 years. The decades were marked by strikes, slowdowns, mine closings, the boom and bust cycle – and environmental costs – that are the devil's bargain in an industry that traces its roots here to 1847.

As he waited for his next customer in a community of fewer than 5,000 people, where the city grid has names like Copper Street and Iron Street and Tracy Mine Road, Remillard predicted a grim aftermath should this industry close up shop.

“If they shut down, it would be just like in copper country, when they closed down the mines. Everybody would move out,” he said.

That might be exaggeration, though Remillard has a point.

He refers to the 1995 closing at the west end of the UP of the White Pine copper mine, which employed 3,000 workers at its peak in the 1970s. Ontonagon County, site of the mine, lost more than 40 percent of its population, falling from 10,548 residents in 1970 to about 6,200 today. Jutting into Lake Superior, the Keweenaw Peninsula is dotted with ghost towns tied to copper mining, in sufficient number they are promoted as a tourist attraction.

Bucking the long string of UP mine closures, a Canadian firm in 2014 launched a high-grade copper and nickel mine about 40 miles west of Marquette. But its scale and projected lifespan won't compensate for the jobs at stake in the iron ore mines. Operating despite opposition from environmental groups like Save the Wild UP, it employs 400 workers, including salaried employees and contractors and is expected to have an eight-year life. It is non-union.

An uneven playing field

As Cliffs fights for survival, officials like Ishpeming City Manager Mark Slown wish the government – somebody – would do more to protect the industry from what he considers unfair foreign competition. It is a common sentiment in this community.

“I am not an expert on this, but what is happening sure looks like dumping to me,” he said.

He refers to the importation of foreign steel, chiefly from China, that is threatening the U.S. steel industry and driving down the price of ore.

In December, the U.S. Department of Commerce proposed a 256 percent tariff on Chinese steel after finding evidence it was subsidized and priced unfairly low. Chinese exporters can challenge the anti-dumping duties at the World Trade Organization, with a final determination not expected for months.

Further complicating the picture, negotiations are stalled between Cliffs and the United Steelworkers over its contract with its UP and Minnesota miners. The previous contract expired Oct. 1.

Patricia Persico, spokesperson for Cliffs, said it is “hard to speculate on a timeline” for when the contract might be settled. She declined to say whether the firm is seeking wage or benefit concessions, given the tough economic climate.

“We don't typically discuss the details of the negotiations,” she said. A spokesman for the United Steelworkers also declined comment on the specifics of the negotiations

As for the future of Cliffs – and the Tilden mine, Persico said: “We are confident about where we are headed and our outlook.”

One Upper Peninsula economic development official said he believes the region would somehow muddle through should the entire operation close.

Dennis West, president of Marquette-based Northern Initiatives, a nonprofit financial development organization, noted the area survived the 1995 closing southeast of Marquette of K.I. Sawyer Air Force Base. The base provided 4,500 military jobs, a thousand civilian jobs and churned out an annual military payroll of more than $100 million a year.

“It took a decade or so, but the population did bounce back. People are resilient in this part of Michigan,” West said.

But West added that mining comprises one leg in the three-legged stool that forms the base of the area economy, the second and third being Marquette General Hospital and Northern Michigan University.

Take out that first leg, West said: “It's not apparent to me there are comparable jobs anywhere.”

Indeed, Cliffs Natural Resources calculated the 2014 economic impact of its two Michigan mines at $827 million, including a payroll of $214 million, $599 million in supplies and services purchased, $130 million in purchased electric power and $14.8 million in state and local taxes.

A rich vein fuels a boom

That all emanated from the discovery of an 1844 surveying party led by William A. Burt – inventor, judge and later, Michigan state representative – who detected wild compass fluctuations in an unsettled area west of what is now Marquette. The party found outcroppings rich with iron ore in the Precambrian rock, in what would become known as the Marquette Iron Range.

Three years later, the Jackson Mining Company began to dig out ore on land that is now part of the city of Negaunee. By 1875, the mine had produced 1.5 million tons of ore. The mining operation was purchased in 1905 by the Cleveland-Cliffs Company – now Cliffs Natural Resources.

And thus began a mining boom that would define the character of the UP.

To the west, copper mining began in earnest in 1845 in the Keweenaw Peninsula. By the 1860s, the UP supplied 90 percent of U.S. copper. The region known as Copper Country generated more mineral wealth than the California Gold Rush, peaking in 1916 at 121,000 metric tons.

Finnish, Swedish, Cornish and Italian immigrants flocked to the UP. With iron ore mines honeycombed in and around Ishpeming and Negaunee and the aptly named UP communities of Iron River, Iron Mountain and Ironwood, the industry built those communities, as their population peaked in the first few decades of the 1900s.

And for some, there was a price to pay.

On Nov. 3, 1926, an explosion at the Barnes-Hecker mine west of Ishpeming released the waters of a swamp immediately above the mine, sending a torrent of debris and water through its tunnels and destroying the mine. Fifty-one miners died, with only one survivor. Only 10 of the 51 bodies were recovered.

A little more than a month earlier, three miners were killed in the collapse of the Pabst Iron Mine in Ironwood, leaving 43 survivors trapped for up to 129 hours. The last miner was pulled out of the rubble shortly before midnight after five days in the mine.

By the 1950s, the UP mines were running low on the higher-grade ore preferred for steel-making. In 1956, Cliffs pioneered a process of converting low-grade ore to iron pellets, by crushing the rock, separating the ore, mixing it with a binder and rolling it into three-eighths-inch pellets. Ore that comes out of the ground at about 28 percent at the Empire mine, 39 percent at the Tilden, is transformed to 60 percent in pellet form.

The underground mines that were an industry standard for a hundred years were supplanted by open-pit operations, as the last UP underground mine closed in Negaunee in 1979.

Ore mining today proceeds on a scale that seems too massive to be real.

Operators scoop out 120 tons of rock at a time with $30 million electric-powered shovels as tall as a seven-story building, dumping the load onto 320-ton diesel haul trucks, each of which rests on six tires that stand more than 12 feet high. Towering plumes of steam rise above the adjacent ore processing plant, as trucks snake their way up the spiraling road lining the mine. The ore is shipped by rail to Marquette or Escanaba and loaded onto freighters, bound for steel mills around the Great Lakes.

The environment pays a price

Beyond its obvious economic impact, the industry left its imprint in other ways.

Outside the Empire and Tilden mines, sprawling basins hold tons of tailing waste, a byproduct of ore production. The basins can be seen from space, the Tilden basin a vivid orange, signature of the rust-colored hematite ore from the mine.

In 2011, the Michigan Department of Community Health issued a fish advisory for lakes and waterways near the mines because of elevated levels of selenium tied to the mining operation. Selenium accumulates up the food chain, creating potential public health problems when people consume contaminated fish.

Cliffs Natural Resources projected it would spend $35 million in 2015 for environmental improvements in its U.S. iron ore operations, including spending for selenium and tailings management.

Under Cliffs’ long-range plans, these basins are to be restored to a natural state once the mines close. Federal law requires that Cliffs, like other mine operators, set aside funds for reclamation of lands affected by mining.

But Kathleen Heideman, board president of Save the Wild UP, a Marquette-based nonprofit environment group, said she worries who will foot the bill when the mines are gone.

“Mining has had an environmental impact. But I don't think the economic cost has been paid fully.”

She noted that much of Negaunee had to be relocated in the early 1900s, when mining destabilized the ground underneath. Parts of the city are off limits today to housing because the ground remains unstable.

In her view, the industry undercuts one of the region's most valuable assets – its natural beauty.

“We are blessed with trees and waters and remote places,” she said, noting that Pictured Rocks National Lakeshore near Munising generates $20 million in annual economic impact.

Pride in a job

Meanwhile, the Cliffs UP operation still rumbles on around the clock, seven days a week. But it does so with far fewer than the estimated 7,000 miners the UP iron ore industry employed in the early 1950s.

Diesel mechanic Frustaglio was hired in 1998, after serving six years in the U.S. Army. He works up to 68 hours a week, most often on rotating shifts that change by the week.

“I think it's really something to be proud of,” he said. “It was my father, my grandfather, great-grandfather, both sides that worked the mines. Uncles, cousins, they worked the mines.”

Frustaglio realizes how good he has it, in an area where a lot of jobs pay $9 or $10 an hour.

“It's pretty much the best job you can get.”

Dan Johnson, 42, also served in the military before hiring in at the mine, four-and-a-half years in the Navy from 1998 to 2002. A 1993 graduate of Munising High School, he worked in a sawmill for five years before joining the Navy and three years afterward, earning about $14 an hour. He was hired at the mine in 2005 and now makes $29 an hour as a plant repairman. When he works a 60-hour week, he brings home a $1,400 check.

But Johnson said the good wages come with tradeoffs. He met his wife, Holly, at work but she left in 2010 to raise and homeschool their four daughters, Echo, 2; Nasheena, 4; Winter, 5; and Remi, 6. They live just outside Negaunee.

On weeks when he's on 12-hour day shifts, he doesn't get home until about 6:30 p.m. The girls' bedtime comes at around 7 p.m.

“It's hard when you have four daughters that don't get to see their daddy,” he said.

Still, the industry has afforded generations of miners, many with just a high school degree, a middle class life and retirement benefits that include health insurance and pension.

Dale Talus, 74, retired in 1997, after 34 years with the union, most of that as a welder at the Empire mine. He is a third-generation miner, descended from ancestors who came from Finland for work in the mines.

A 1961 graduate of Negaunee High School, Talus and his wife, Barbara, raised three children, using his wages to buy a two-story home that was paid for at least 20 years ago. Barbara died two years ago.

“It was good benefits, good wages,” he said. “I don't have too many complaints. Everything I have is paid for.”

Talus said he gets by with the help of his $1,400 pension, plus Social Security payments. A year ago, he had part of a cancerous lung removed. His health insurance paid most of the costs not covered by Medicare. He had cataracts removed from both eyes two years ago. His insurance paid all but $48 of a $5,300 bill.

But he worries what the next generation, especially those without high school degrees, will do the day the mines shut down for good.

“It's going to be pretty rough,” he said.

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!

Ore is trucked for processing in 320-ton haul trucks that stand 24 feet high and cost about $5 million. (Photo courtesy Cliffs Natural Resources)

Ore is trucked for processing in 320-ton haul trucks that stand 24 feet high and cost about $5 million. (Photo courtesy Cliffs Natural Resources) Restaurant owner Sherri Steele says miners and retired miners are a big part of her customer base. (Photo by Ted Roelofs)

Restaurant owner Sherri Steele says miners and retired miners are a big part of her customer base. (Photo by Ted Roelofs) Mining industry analyst Garrett Nelson said the future of mine owner Cliffs Natural Resources is up in the air. (Courtesy photo)

Mining industry analyst Garrett Nelson said the future of mine owner Cliffs Natural Resources is up in the air. (Courtesy photo) Miner Peter Frustaglio Jr.: “It's pretty much the best job you can get.” (Photo by Ted Roelofs)

Miner Peter Frustaglio Jr.: “It's pretty much the best job you can get.” (Photo by Ted Roelofs) Negaunee barber Paul Remillard says “everybody would move out” if the mines close. (Photo by Ted Roelofs)

Negaunee barber Paul Remillard says “everybody would move out” if the mines close. (Photo by Ted Roelofs) Taking Stock: As ore prices fell, the stock of Cliffs Natural Resources – owner of Michigan's two UP mines – has plummeted in the past five years:

Taking Stock: As ore prices fell, the stock of Cliffs Natural Resources – owner of Michigan's two UP mines – has plummeted in the past five years: Iron Ore Tumbles: The value of iron has dropped by nearly 80 percent in five years, as the world commodity boom faded. The global iron ore spot price:

Iron Ore Tumbles: The value of iron has dropped by nearly 80 percent in five years, as the world commodity boom faded. The global iron ore spot price: Opened in 1963, the Empire Mine west of Marquette is a mile wide and more than a thousand feet deep. (Photo courtesy Cliffs Natural Resources)

Opened in 1963, the Empire Mine west of Marquette is a mile wide and more than a thousand feet deep. (Photo courtesy Cliffs Natural Resources) The tailings basin for the Tilden mine can be seen from space, even down to its vivid orange color. (Photo courtesy of Save the Wild UP)

The tailings basin for the Tilden mine can be seen from space, even down to its vivid orange color. (Photo courtesy of Save the Wild UP)