Four reasons why Michigan college prices have skyrocketed (Chapter 3)

The rising price of a college education nationwide has been blamed on everything from administrative bloat and tighter state budgets, to an arms race of amenities such as luxe dorms, state-of-the-art athletic facilities and gourmet dining in a battle for students and top rankings.

In Michigan, let’s look at four factors (among many) that are impacting family budgets:

#1: Michigan lowered state funding to public universities

In 1990, Michigan sent $1.06 billion to the state’s public universities. If state spending on higher education had remained steady in 2014, when adjusted for inflation, universities would have received $1.92 billion. Instead, colleges got $1.26 billion, a 34 percent decrease after inflation.

With less money coming from taxpayers, universities collected more from students through higher tuition.

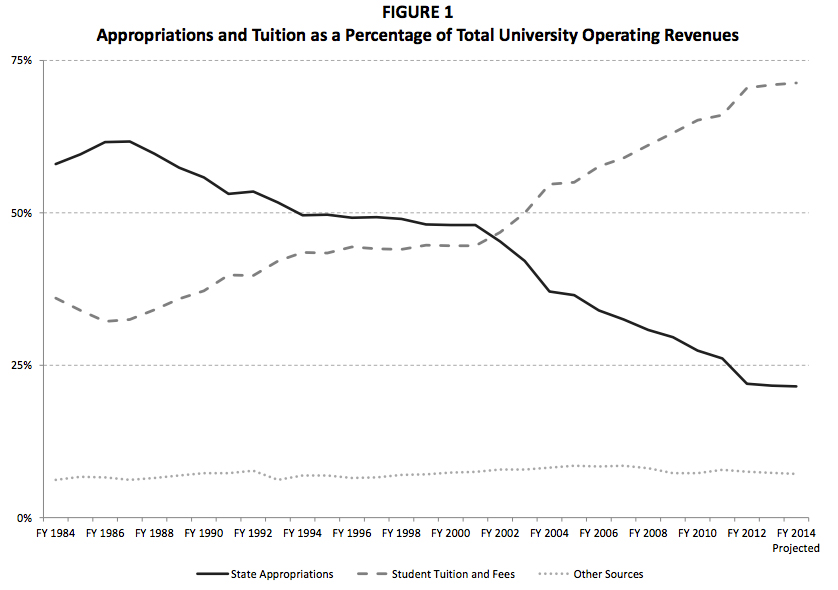

The share of public university budgets coming from the state budget plummeted from 48 percent in 2001-02 to 21.5 percent in 2013-14, according to a report issued by the nonpartisan Michigan House Fiscal Agency. During that same period, the share of college budgets supported by tuition jumped from 44 percent to 71 percent.

“Almost all of the increase (in college costs) is because of decreased state support,” said Mike Boulus, executive director of the President’s Council of State Universities of Michigan, the advocacy organization for the state’s 15 public universities.

A House Fiscal Agency analysis concluded lower state funding is the cause of between 60 percent and close to 100 percent of tuition increases, depending on different inflation formulas and whether increased student aid is counted.

“There’s no question tuition would be lower (if state funding had remained stable),” Boulus said.

How much lower? Boulus doesn’t have a ready answer. But if tuition made up the same percentage of the per-student cost of education today as it did in 2001-02 (42 percent, rather than the current 70 percent), tuition, on average, would be about $3,300 lower per year at Michigan public universities. That amounts to a savings of more than $13,000 over four years on campus.

Of course, more money for higher education would mean either less money for other state programs – K-12 education or roads, for example – or higher taxes.

After years of cuts, public universities have had four straight years of funding increases. “We’ve turned a corner,” Boulus said.

#2: The salaries of the people teaching college classes

College is a service industry, and service takes employees. About 63 percent of state university budgets are eaten up by salaries and benefits, according to the House Fiscal Agency report.

Labor can eat up even more of the budgets of small, liberal arts colleges where there is less overhead, said Don Heller, dean of the Michigan State University School of Education, whose area of research is higher education economics.

“It’s a labor intensive industry with high-demand, high-priced labor,” Heller explained.

As enrollment has risen at Michigan’s public universities (up 13 percent since 2001), so has teaching faculty (up 15 percent) and their paychecks (up an average of 12 percent after inflation is factored in).

“Typically, improved technology means fewer people and lower prices,” Heller said. “We can buy books cheaper today because of the competition of Amazon.” But universities have “not been successful at replacing labor with capital.

Many of the faculty can make more money outside of universities, which keeps salaries rising.

“My faculty in K-12 leadership could get jobs as superintendents or even principals and often make more money,” Heller said. “The faculty at the business school could make more money (outside of academia); the law school faculty, too.”

Slashing salaries is problematic, because faculty pay at Michigan schools isn’t out of line with other peer public universities around the country. Michigan State University’s average faculty salary is near the bottom among Big Ten schools.

Cutting positions is possible if class size is increased or more courses are taught online. But “even online courses often are the same size as in-person classes” because professors still have to grade papers and interact with students, Heller said.

#3: State scholarships evaporated

Between 2003 and 2013, Michigan was dead-last in the nation in the increase in the amount of aid the state offered college students ‒ over this period, the state actually decreased aid by more than $125 million. Michigan was one of six states to decrease aid, and the decrease here was the largest in the nation by far.

Michigan’s primary state-funded scholarship program for college students, the Michigan Promise scholarship, was cut from the budget in 2009 at a time when the state was desperately looking for ways to eliminate a deficit.

The Promise scholarship was a merit-based scholarship program that provided up to $4,000 toward post-secondary education at any approved Michigan institution to qualifying Michigan high school students.

At Grand Valley State University alone, the Michigan Promise paid $11 million toward tuition for students in 2006-07, according to Lynn Blue, vice provost and dean of academic services and technology at GVSU.

“We didn’t have additional funds to make that blow (to family budgets) go away,” Blue said.

The Promise scholarships cost the state about $140 million a year.

Michigan’s total funding for student aid today ranks it in the bottom half of states. Some comparisons: student aid offered in 2013, per capita, across several nearby states:

- Michigan: $93 million ($9.38 per capita)

- Ohio, $122 million ($10.52 per capita)

- Kentucky, $198 million ($44.86 per capita)

- Minnesota, $253 million ($46.36 per capita)

- Indiana, $285 million ($43.20 per capita)

- Tennessee, $375 million ($57.25 per capita)

- Illinois, $379 million ($29.42 per capita)

#4: Students are taking longer to get a degree

Twelve of Michigan’s 15 public universities have four-year graduation rates below the national public university average of 31 percent; Only four private colleges (Kalamazoo, Hope, Calvin and Albion) of 39 in the state have four-year graduation rates above the national private school rate of 52 percent.

Extra semesters on campus mean extra tuition, fees, room and board.

“The real rising cost of debt is year five and six,” said Boulus. “You add 20 percent to your cost in year five, and another 20 percent in year six.”

The added expense of these extra years was chronicled by Bridge in “The five-year four-year degree.”

The University of Michigan at Ann Arbor has the best four-year graduation rate among the state’s public universities, at 76 percent; Saginaw Valley State University has the lowest, at 9 percent. Hope College, at 67 percent, has the highest four-year graduation rate among Michigan’s private colleges.

While not enough of them graduate on time, most Michigan full-time students eventually earn a degree. A report released today by the National Student Clearinghouse Research Center reveals that 89 percent of Michigan-resident students who enroll full-time at a four-year public university get a bachelor’s degree within six years – the third-highest rate in the nation. Getting more of them to graduate in four years could save those students and their families tens of thousands of dollars.

“I tell parents, ‘Make sure your kid finishes in four years,’” Boulus said.

Michigan Education Watch

Michigan Education Watch is made possible by generous financial support from:

Subscribe to Michigan Education Watch

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!

click to enlarge

click to enlarge