Indebted millennial to boomer: Do we have you to thank for this?

My first professional job in journalism was as a part-time copy editor at the Lansing State Journal on the features desk, an opportunity I have always been grateful for. I was an old 21, about to turn 22, landing what I’d thought – at the time – was a gig of a lifetime.

The LSJ was a fantastic paper with a lot of recognizable bylines I’d familiarized myself with during my time at Michigan State University, and I’d watched reporters there springboard to larger papers in Michigan. But if there’s one thing I’ll never forget about my time there, it was some comments from John Schneider, who’d been the metro columnist for 20 years or so before leaving for other pursuits, including Bridge -- where we’re now sharing bylines once again.

When John found out that the LSJ was my “first” paper, he remarked that “when I was starting out, you had to work at two or three smaller papers before making your way to the State Journal.” Huh. Not quite the advice I was expecting from a veteran.

At the time, I shrugged it off, but I was reminded of those sentiments – the elder condescendingly scolding the younger – when similar comments popped up in John’s Bridge column last week wondering how today’s college graduates wind up in so much debt.

“But there are other, less expensive ways, to get a college education,” Schneider wrote. “For example, starting off at a community college, living with parents for the first year or two, taking one of those part-time jobs nobody else wants, or working during the day and going to night school.”

I’ll tell you what, John – we were told to stay away from community colleges because job recruiters (from your generation) would be looking closely at transcripts to see if graduates were able to handle four years in a sustained environment. (My experience? As a high schooler, I was told to go to a four-year institution and get on whatever that school’s newspaper staff immediately; clips from two-year college papers wouldn’t be enough to get a job.)

Most of us chose to attend schools away from home because we wanted the best education possible (again, told to us by the previous generation if we wanted a job), which meant having to move away from home. And yes, we did work part-time in between classes, often working in fields similar to what we were studying (which your generation told us to do if we wanted a job).

John also grouses about one particular student’s choice to study abroad, which is baffling since he lives in the back yard of one of the best study-abroad programs in the nation (which, by the way, often costs just as much per credit hour as a normal class on campus). Again, we were told to study abroad because job recruiters (from your generation) said we need a “worldly, well-rounded” experience...if we wanted to get a job.

But when John talks about the costs of higher education and why our generation should just “pay up” for it, it shows he’s shockingly out-of-touch with trends that have affected recent college attendees over the last decade or so.

Divorce rates soared around the late 1970s, peaked in the 1980s and finally began to drop off in the 1990s – right around the time when the current crop of debt-laden graduates were born. Though well-meaning parents would love to help as much as they can, their contributions on single incomes were likely minimal, so we had to take out loans. But even students from dual-income homes might not have had a golden parachute landing onto campus; the cost of raising a child is another bill that has spiked dramatically with no peak in sight.

Other crises aside – incomes stifled in the 1980s, the foreclosure and unemployment crises of the 2000s and 2010s – I wonder if John ever had the conversations I had with students at MSU while I was there, beyond his own children. Things like “my parents don’t have education,” “I’m the first in my family to go to college,” “there’s no future for me back home” were strong indicators that college was out-of-reach and absolutely necessary all at once.

No recent college graduate doesn’t want to pay back the costs of higher education. John is absolutely right that we knew what were getting into. Where you’re confused, John, is mistaking reluctance to pay back for refusal to pay back. Hell yeah, we’re going to complain about the cost of loans – they’re expensive! You’ve never complained about the cost of anything, ever? And we’ve got other things to pay for: Food, shelter, clothes. But the obvious thing we’re trying to pay for is the kind of lifestyle your generation told us to pursue.

Give us a break and let us deal with our own finances, or maybe you guys can help out. Your choice.

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!

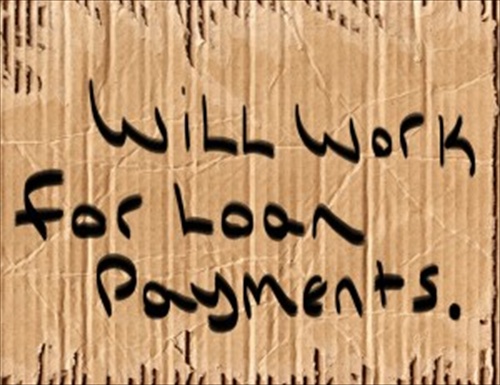

It would have been nice to follow all that sensible advice about keeping student loans manageable, but not all of it was possible. (Photo by Flickr user marsmettnn tallahassee; used under Creative Commons license)

It would have been nice to follow all that sensible advice about keeping student loans manageable, but not all of it was possible. (Photo by Flickr user marsmettnn tallahassee; used under Creative Commons license)