The definition of "Anti-tax conservative" has changed

11 things every Michigan taxpayer should know

Comparatively, Michigan's tax burden is low - and getting lower.

Look around: YOUR taxes could be much higher.

Michigan gives more tax breaks than it collects for schools/gov't.

The definition of "Anti-tax conservative" has changed

Why might taxes seem high to YOU?

The motivation for a state income tax cut.

What might YOU get out of an income tax cut?

Snyder is a Republican. Why his experts want to spend more.

Can we cut taxes and spend more on education/infrastructure?

Remember how we said Michigan had high taxes in the late 1970s? Well, voters back then noticed – and revolted.

In 1978, voters approved a constitutional change – “The Headlee Amendment” – which limited annual total state tax revenue to no more than 9.49 percent of all the personal income earned by Michigan residents.

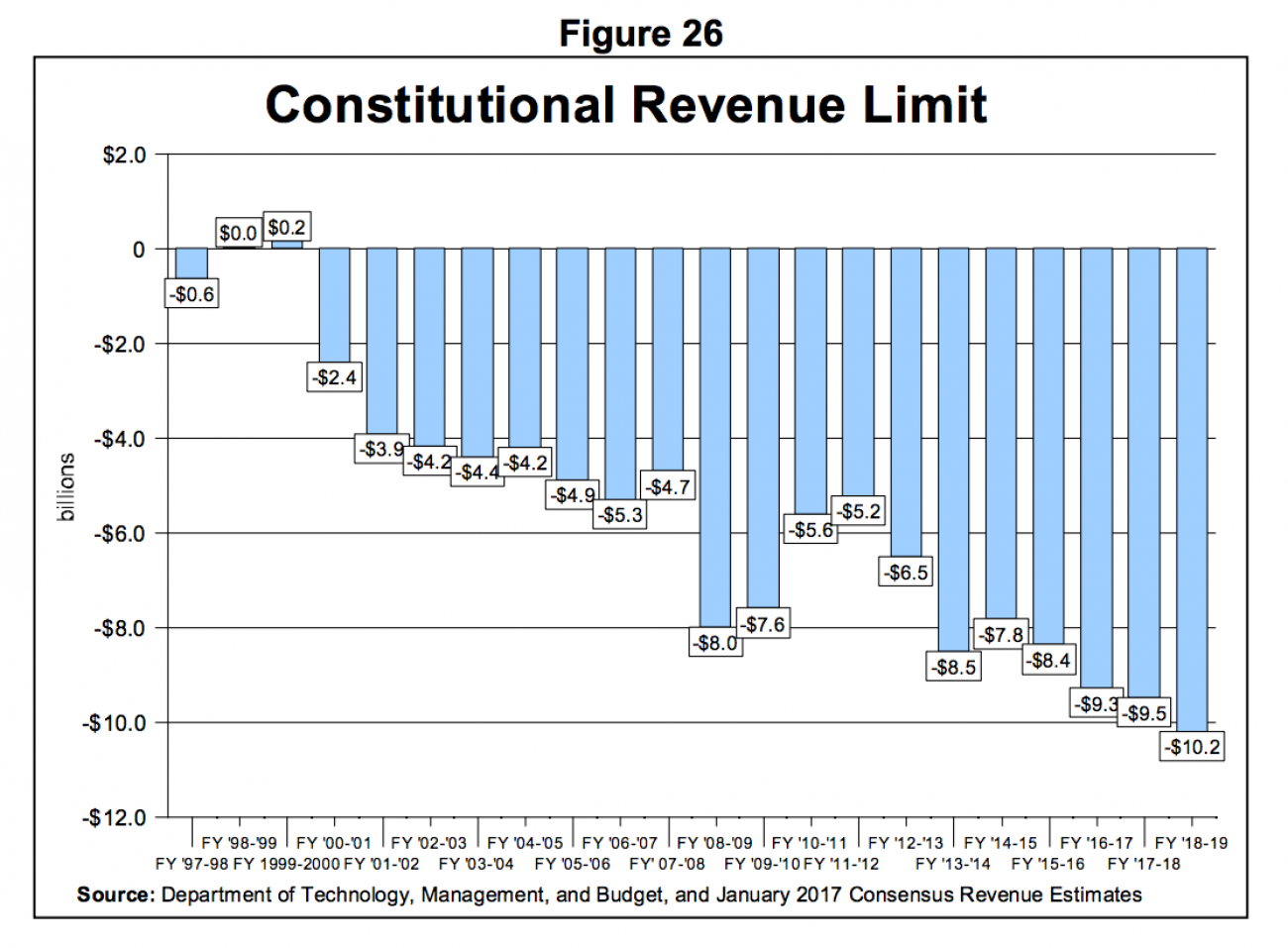

The amendment was named for Richard Headlee, an anti-tax, conservative Republican and insurance executive. In this century, state tax revenue has remained far below the 9.49 percent Headlee cap (see graphic below, which shows how many billions of dollars below the Headley cap Michigan has fallen each year).

In 2015, for example, the rate collected was 7.6 percent. Cumulatively since 2000, Michigan tax revenues are $120 billion less than the Headlee limit allows. That’s the equivalent of $12,000 less in tax collections since 2000 for every Michigan resident.

In other words, Michigan’s recent and current tax policy is far more fiscally conservative and taxpayer-friendly than what tax-fighter Richard Headlee won in his tax-limitation victory more than a generation ago.

Yet this year, a significant block of Michigan legislators has been seeking an income tax cut that has ranged, in negotiations, from $250 million to more than $1 billion.

The definition of “anti-tax conservative” has changed.

Business Watch

Covering the intersection of business and policy, and informing Michigan employers and workers on the long road back from coronavirus.

- About Business Watch

- Subscribe

- Share tips and questions with Bridge Business Editor Paula Gardner

Thanks to our Business Watch sponsors.

Support Bridge's nonprofit civic journalism. Donate today.

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!