Factory work drives slow Mich. recovery

If there’s one thing we’ve always been able to count on in Michigan, it’s that manufacturing will drag us into recession and lead us back to recovery.

And it’s happening again.

Durable goods manufacturing output has jumped 41 percent in the past two years, far outpacing any other segment of the economy since 2009.

The value of durable goods, including cars, auto parts, office furniture and machinery, rose from $39.5 billion in 2009 to $55.9 billion last year, according to figures from the federal Bureau of Economic Analysis.

“Business is great,” said Michael Chetcuti, who runs a diversified manufacturing company in Livonia that struggled through the Great Recession, but now employees 600 workers.

Among other products, Chetcuti’s Quality Metalcraft Inc. manufacturers a customized Jeep Wrangler for heavy off-road use that is sold through 48 Jeep dealers.

Overall, real gross domestic product in Michigan rose 7.3 percent from $314.6 billion in 2009 to $337.4 billion last year.

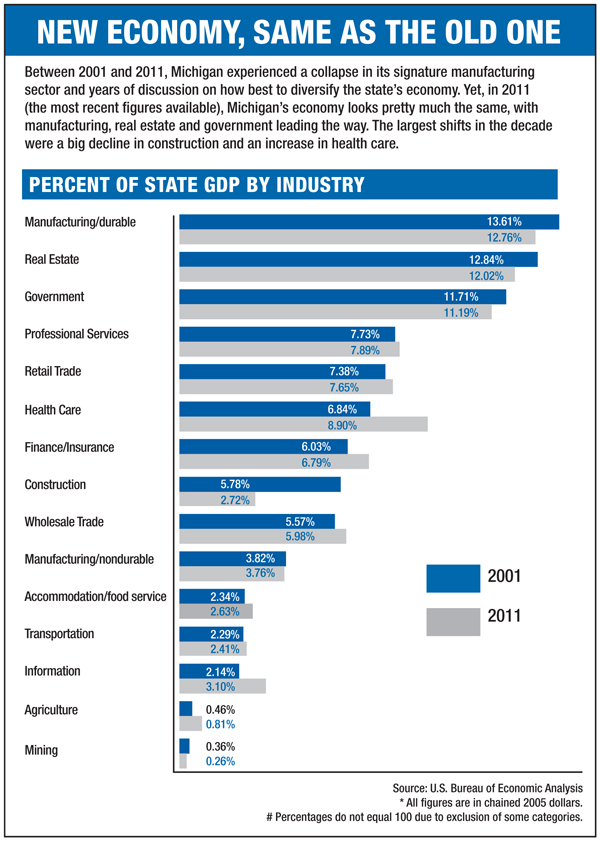

Total manufacturing, including food, chemical and paper manufacturing, comprised 16.5 percent of Michigan’s economic output last year, up from 12.6 percent during a depressed 2009.

Bridge: Construction industry sees more work, more jobs on Michigan's horizon

Real gross domestic product is the inflation-adjusted value of goods and services produced in a year.

A breakdown of the value of the various manufacturing segments isn’t yet available. But experts say car and truck production likely dominated the growth in manufacturing GDP.

“It’s always been the auto industry,” said Paul Traub, an economist in the Detroit branch of the Federal Reserve Bank of Chicago.

Auto production in the state nearly collapsed during the Great Recession as sales fell to their lowest levels in nearly 30 years, and General Motors and Chrysler went into bankruptcy.

But car and truck production jumped 73 percent between 2009 and 2011, according to industry analyst Alan Baum in West Bloomfield.

Baum is forecasting Michigan vehicle production of 2.3 million cars and trucks this year, more than double 2009’s output of 1.1 million vehicles.

And Michigan’s share of North American vehicle production is likely to grow to 15 percent this year from 13.3 percent in 2009, according to Baum.

Work-force concerns limit growth

Manufacturing in the state might be able to expand even more if companies could find enough toolmakers, machine operators and other workers, said Charles Hadden, president of the Michigan Manufacturers Association.

“I have people telling me they have machines sitting idle that they could use if they could find people to operate them,” he said.

Many skilled and production workers either left the state or found jobs in other segments of the economy after automakers and other manufacturers laid off hundreds of thousands of workers in the Great Recession.

Hadden said manufacturers also are confronting an aging work force and large numbers of retiring workers.

“There’s nothing in the pipeline” to replace them, he said.

Hadden said he’s also concerned that auto-related manufacturers have abandoned diversification efforts begun during the recession as auto manufacturing recovers.

“My worry is that they are so busy with their auto business, they let (diversification) slide,” he said.

A continued over-reliance on auto manufacturing could make the next downturn particularly harsh for the state’s economy, as has happened in previous business cycles.

And there is evidence that manufacturing, which is a mainstay of the global economy, is slowing.

The Chicago Fed Midwest Manufacturing Index fell in August, September and October after months of in increases. The auto production component of the index was flat in October after falling in August and September.

“Manufacturing is tailing off because of the problems in Europe and China’s economy is slowing down,” Traub said. “And the ‘fiscal cliff’ is worrying business owners” who have slowed investment spending.

“Fiscal cliff” refers to the expiration of a variety of tax cuts and spending increases that will take effect Jan. 1 unless Congress acts to make changes.

Bridge: Health sector surges, but Michigan economy still faces educational drags

“The fiscal cliff is already exerting a drag on the economy, whether or not we actually go over it,” said Robert Dye, Comerica Bank’s chief economist.

Traub is forecasting Michigan GDP will slow this year to 1.5 percent from 2.3 percent last year, mainly because of the slowdown in the global economy.

A long-range University of Michigan forecast, prepared earlier this year for the Michigan Department of Transportation’s Bureau of Transportation Planning, projects Michigan’s economy will grow at an average annual rate of 1.6 percent through 2040, as measured by GDP.

Future factories will be lonely places

But the number of manufacturing jobs is likely to decline over the long term, mainly a result of machines and other technologies reducing the labor content of manufactured goods.

Manufacturing jobs are expected to fall by an average annual rate of 0.5 percent a year through 2040, according to the U-M forecast, one of just two industry segments expected to shed jobs in the period. The other is trade, transportation and utilities.

“The prospects for employment in the auto industry, and in manufacturing in general, are less favorable in our view as we expect fairly robust long-term productivity growth over time,” the forecast said.

And despite the current boom, Chetcuti said he’s pessimistic about the future of manufacturing, particularly in Southeast Michigan.

“It’s going to continue to shrink,” he said. “Detroit is a great place to manufacture high-end goods. But it can’t compete with Korea and China in the mass market.”

Rick Haglund has had a distinguished career covering Michigan business, economics and government at newspapers throughout the state. Most recently, at Booth Newspapers he wrote a statewide business column and was one of only three such columnists in Michigan. He also covered the auto industry and Michigan’s economy extensively.

Business Watch

Covering the intersection of business and policy, and informing Michigan employers and workers on the long road back from coronavirus.

- About Business Watch

- Subscribe

- Share tips and questions with Bridge Business Editor Paula Gardner

Thanks to our Business Watch sponsors.

Support Bridge's nonprofit civic journalism. Donate today.

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!