Road repair enjoys bipartisan support

On Michigan's Right to Work law, labor activist Mark Schauer and business advocate Rich Studley could not have sought more different results.

But when it comes to working on Michigan's crumbling roads -- an issue that's arisen in Lansing nearly as frequently as winter potholes -- the two have an identical goal.

Schauer, a former Democratic congressman and potential 2014 gubernatorial candidate, and Studley, the head of the Michigan Chamber of Commerce, are together in a broad coalition that is pushing for increased funding for Michigan roads.

“Nobody is happy with the condition of roads and infrastructure, the unemployment rate that lingers in our state,” said Schauer, business development representative with the Michigan Laborers-Employers Cooperation & Education Trust and a member of Michigan Laborers Local 355 in West Michigan. “We’re at the table together, trying to solve it.”

Studley, president of the chamber, said transportation investment in Michigan has historically “been a bipartisan issue and an issue where business and labor have worked together. It’s a new year, it’s a new legislative session … it is a good opportunity for lawmakers on both sides of the aisle, in both houses … to do something positive.”

Whether a message of economic and public benefits helps overcome legislative resistance to raising taxes and the lingering political resentments of last December’s Right to Work battle remains to be seen.

“You’ve got a lot of the most powerful interest groups in Michigan, coming together and urging a solution, and there really is no organized opposition to it. But politicians will take polls, they will find out at Rotary meetings, that there’s a lot of animosity to any increase in tax,” said Craig Ruff, senior policy fellow at Public Sector Consultants, a nonpartisan public-policy Lansing research firm.

How to get $1 billion-plus for roads?

Gov. Rick Snyder outlined in his January State of the State address a concept for $1.2 billion more annually to fix roads. The administration said this would add up to an average $120 more per vehicle by shifting from Michigan’s per-gallon 19-cent gasoline tax and 15-cent diesel tax to a percentage tax at the wholesale level, and increasing vehicle registration fees. He also called for allowing optional local or regional registration fees.

Snyder told the Detroit News Wednesday that he wants to level the fuel levy between gasoline and diesel and that his call for $1.2 billion in additional road money would be split between $700 million from the shift to a wholesale fuel tax and $500 million from higher registration fees. The governor is expected to give more details at his formal budget presentation in Lansing at 11 a.m. today.

Having $1.2 billion in additional funds for transportation could provide a variety of fixes to about 2,600 additional lane miles each year throughout Michigan, between state and local road systems, the Michigan Department of Transportation says. That’s about 2.7 times the amount of road preservation currently planned in MDOT’s five-year state highway road program. (Lane miles are one mile of one lane of highway, per direction.)

Legislation filed by Sen. Roger Kahn, R-Saginaw Township and chairman of the Senate Appropriations Committee, however, would raise $1.6 billion, though the methods would follow the concept outlined by Snyder: a higher state registration fee and a switch to a wholesale tax on fuel, eliminating the current per-gallon levy. (The legislation does not include a local registration fee option.)

Either way, MDOT says the additional revenue would enable it to do more long-term fixes to roads and pavements would stay in good shape for a longer period of time.

[polldaddy poll=6878482]

Other benefits: An estimated 12,000 jobs from the additional road spending, safer driving conditions and reduced damage to vehicles. Family cars see an average of nearly $400 in repairs per year attributable to poor roads – the highest among neighboring Great Lakes states, according to data compiled by MDOT.

Kahn’s funding approach has two central aspects. One is an approximate 80 percent increase in vehicle registration fees that would generate about $650 million, coupled with changing the gasoline tax to a percentage tax at the wholesale level and generating from that around $950 million in revenue.

The percentage tax rate would be the same for gasoline and diesel and would initially equate to an 18-cent increase per gallon for gasoline, compared with current levels, and 22-cent increase for diesel. Increases or decreases in the tax rate would be limited to one cent per year.

The Kahn proposal comes with a twist: a choice.

A measure tied to the other changes would put before voters statewide the option of a 2-cent increase in Michigan’s 6-cent sales tax, with resulting revenue dedicated to transportation funding. If voters approved that option, Michigan’s taxes on gasoline and diesel would be eliminated and registration fees would return largely to their current levels, Kahn said.

The Snyder administration hasn’t specified a tax amount it wants out of the Legislature, nor how much new revenue might come from the wholesale tax and how much would come from registration fees.

Stability is goal in tax shift

The idea behind going to a percentage-based tax, rather than a per-gallon tax, is to produce a more stable source of funding. Gas tax revenues have declined as people have driven less and purchased more fuel-efficient vehicles, hybrids and electrics, while at the same time road-construction costs have risen.

State gasoline and diesel taxes produce about $946 million annually and make up about a third of Michigan’s total $2.8 billion road and bridge funding pie. State registration fees produce $876 million, and federal funds provide $1 billion. This year only, there's an additional $100 million in state funds, to match federal money.

MDOT Director Kirk Steudle couldn’t say how the size of pie slices might change.

“What the governor outlined is that in order to maintain what we have, each vehicle needs a user fee of an additional $120,” he said. “I think when the sausage gets done here, there’s going to be a mix.”

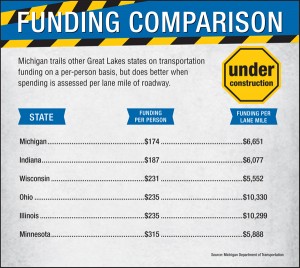

Compared with Great Lakes states Illinois, Indiana, Minnesota, Ohio and Wisconsin, Michigan’s 19 cent gasoline tax is among the lowest. Indiana’s 18-cent levy is at the bottom, followed by 19 cents in Michigan and Illinois, 28 cents in Ohio, 28.5 cents in Minnesota and 30.9 cents in Wisconsin, according to MDOT data.

An analysis by the nonpartisan Citizens Research Council of Michigan last year noted that if Michigan's current 19-cent levy were adjusted for inflation, it would be about 27 cents per gallon now.

In diesel taxes, Michigan is at the bottom among the six states, with its 15-cent level comparing to 16 cents in Indiana, 21.5 cents in Illinois, 28 cents in Ohio, 28.5 cents in Minnesota and 30.9 cents in Wisconsin.

Michigan’s registration fees are also lower than several of those Great Lakes states, according to an MDOT sampling.

Navigating the political map

But increasing road revenue won’t be an easy sell. And it hasn’t been for years.

“The state has a whole lot of taxpayers who feel they’re overtaxed and that there’s a lot of waste and inefficiency … it’s just not easy to raise a tax for anything,” said Public Sector’s Ruff. “I do think this, that roads are different in the sense that there’s more than likely a keener appetite for a user tax if the public believes that the roads are in such disrepair that they have to have more money” put toward them.

Thus the pitch – “save money, save lives, just fix the roads” – of a $500,000 to $600,000 advertising campaign from the Michigan Transportation Team, said Mike Nystrom, co-chair of the 50-plus-member group of business, labor, government, and other interests that hope to convince lawmakers to act. He is also executive vice president of the Michigan Infrastructure & Transportation Association.

“It’s definitely an uphill battle,” Nystrom said, of resistance to tax increases. “But in the end, doing nothing is not an option. So we’re going to have to plow through the political challenge before us and decide that we’re going to find a solution that helps to move Michigan forward.”

Michigan State University professor of economics Ken Boyer said, “It is not just in Michigan that there is strong opposition to raising the fees for either owning a car or for driving it a mile. The standard explanation is that drivers do not understand how roads are financed or are cynical that increases in revenues for roads will improve their driving experience. But I do think that we should take seriously another possibility – that people are satisfied with roads as they are now and do not see an advantage to making them better.”

The solutions that surfaced in January, found disfavor with House Democrats. House Minority Leader Tim Greimel, D-Auburn Hills, said an increased sales tax “disproportionately affects middle class and working families because they spend a higher portion of their income on purchasing goods” as compared with wealthier individuals, and he said there would be similar impact from higher fuels tax and registration fees.

“Obviously, our roads are in tough shape and it’s important to find a solution to address the problem. But it’s got to be the right solution,” Greimel said. “We should not rush to do something if it doesn’t make sense for Michigan’s families. Any funding solution has to be fair and equitable in terms of who bears the financial burden, and any solution needs to be sustainable.”

Interviewed in late January, Greimel said his caucus is looking at options, but had not yet formulated a position.

Democratic votes are going to be needed to support increased fees or taxes “because there are going to be Republicans from conservative areas who are going to get a lot of pushback from constituents” about raising any taxes, said Ruff. In this Legislature, Republicans control the House 59-51, and dominate the Senate, 26-11.

The chamber’s Studley will be among those messaging in the Capitol.

“I’ll be reminding lawmakers, whether they’re Democrats or Republican, that this is a critically important issue” to economic competitiveness and jobs, including those in lawmakers’ districts, Studley said.

He said on the Republican side of the aisle, the chamber will explain the governor’s “user fee” proposal as a conservative and traditional approach. “There’s a difference between a true user fee … and general taxing,” Studley said.

And, he said, “we’ll be reminding lawmakers on both sides of the aisle, that when transportation funding was increased in 1997, not a single lawmaker who voted to increase transportation funding, lost an election because of that issue.”

Business Watch

Covering the intersection of business and policy, and informing Michigan employers and workers on the long road back from coronavirus.

- About Business Watch

- Subscribe

- Share tips and questions with Bridge Business Editor Paula Gardner

Thanks to our Business Watch sponsors.

Support Bridge's nonprofit civic journalism. Donate today.

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!

CLICK TO ENLARGE

CLICK TO ENLARGE