Smaller communities buck tax loss trend

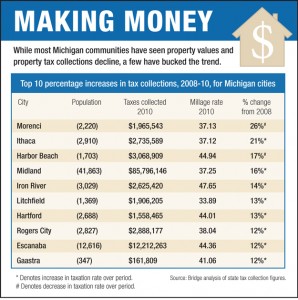

Dozens of cities, villages and townships -- most of them small in population -- have seen tax revenues actually rise over the past three years despite an overall revenue decline inMichigan.

Those increases mainly have been a result of one or two new commercial projects that have sharply boosted property values in local taxing jurisdictions.

Morenci, a town of about 2,000 residents in Lenawee County, posted the biggest percentage increase in property tax revenues of any city in the state between 2008 and 2010.

Tax revenues there rose 26 percent to $1.9 million in 2010.

Martin Marshall, Lenawee County’s equalization director, said the increase was almost entirely due to a plant expansion by Schoeller Arca Systems Inc., which manufactures plastic shipping pallets.

That expansion included the addition of about $10 million worth of machinery since 2009, Marshall said. The machinery, taxed as personal property, offset a decline in property values in the rest of the city, Marshall said.

Morenci’s tax rate fell 1.4 mills between 2008 and 2010.

Ithaca, located in Gratiot County, south of Mount Pleasant, saw property tax revenues increase 21 percent between 2008 and 2010, the second-highest increase among cities. The city of 2,900 residents collected $2.7 million in property taxes last year.

Ithaca, located in Gratiot County, south of Mount Pleasant, saw property tax revenues increase 21 percent between 2008 and 2010, the second-highest increase among cities. The city of 2,900 residents collected $2.7 million in property taxes last year.

City Manager Chelsey Foster said much of the increase, strangely enough, was a result of a failed ethanol plant that continues to generate tax revenues for the city.

Construction on the planned $200 million project was halted in 2007 after the developer ran out of money. The current owner, ICM Inc. of Colwich, Kan., continues to pay taxes on about $60 million worth of real and personal property, Foster said.

Ithaca also has experienced retail growth and attracted new companies to its industrial park, offsetting declines in residential real estate values.

“We’ve been kind of an anomaly with all this industrial construction,” Foster said.

Tax rates have risen 3.9 percent in Ithaca since 2008.

Overall, the more than 270 cities in Michigan saw total property taxes levied -- including city, county and school taxes -- fall $375 million from 2008 to 2010, a 6 percent decline.

About this projectTo assess the effects of declining property values on tax collections and household budgets, Bridge Magazine took data from the Treasury Department gleaned from all ofMichigan's local governments. The result was a $1.6 billion cumulative tax cut between 2007 and 2010, adjusted to 2010 dollars. $1.6 billion shaved off Michigan property tax bills On the block: Taxes in Lansing, Troy, Wyoming Despite $300 million reduction, businesses seek relief What was Shadow Tax Cut in your town?

|

That’s despite an average 3 percent millage rate increase in cities statewide. Ninety-three cities saw property tax revenue increases since 2008 while 168 experienced revenue declines.

Midland posted the largest tax revenue increase among the 20 largest cities in the state over the past three years, one of just two cities in the top 20 to see taxes rise.

Kentwood’s revenues went up 3 percent, while Grand Rapids’ taxes were flat over the past three years. The remaining 17 largest cities saw revenues decline.

Midland’s 16 percent revenue increase can mostly be explained by one word: “Dow.”

Dow Chemical Co., the city’s longtime major employer, and several related companies buoyedMidland’s economy during the recent Great Recession, even as many otherMichigancities struggled.

The company is part of a joint venture called Dow Kokam, which will make advanced batteries for electric and hybrid vehicles. And Dow Solar recently entered the solar roof shingle market.

Those firms have fueled additional business and residential growth in the community, said Midland city assessor Reid Duford.

“Midland is in a little different situation than the rest of the state,” he said.

Tax rates in Midland rose 5.1 percent between 2008 and 2010.

Dam collects dollars for Champion

The rebuilding of a burst dam led to tiny Champion Township (population 297) in the Upper Peninsula’s Marquette Countybecoming the leader among townships in tax revenue increases.

Tax revenues more than doubled to $584,904 between 2008 and 2010, almost entirely because of the dam reconstruction, said Jackie Lykins, deputy equalization director in Marquette County.

Champion Township’s tax rate also rose 3.7 percent between 2008 and 2010.

During that same period, as the dam was rebuilt, the taxable value of the dam and the surrounding 80 acres of property rose from $525,000 to $4.8 million.

Property taxes in Michigan’s 1,200 townships fell $225 million between 2008 and 2010, even though the average statewide millage rate in the townships rose 2 percent.

A reassessment of every parcel of land and a hike in its millage rate resulted in property tax revenues in the Southwest Michigan village of Michiana rising 28.8 percent between 2008 and 2010.

That rate of increase was surpassed only by the villages of Onekama at 35.3 percent and Harrietta at 30.9 percent.

Michiana, a village of just 182 people on the Indiana border, collected $598,171 in property taxes last year.

New Buffalo Township assessor Nathan Brousseau said every one of the village’s 800 parcels was reassessed in 2009 because assessments hadn’t been updated in years.

That, and a .9963 mill increase to retire debt led to taxes rising 28.8 percent since 2008.

Statewide, property tax revenues in the state’s 250 villages fell $16 million since 2008 to $88 million in 2010. Property tax millage rates in the villages were down an average 2 percent.

Business Watch

Covering the intersection of business and policy, and informing Michigan employers and workers on the long road back from coronavirus.

- About Business Watch

- Subscribe

- Share tips and questions with Bridge Business Editor Paula Gardner

Thanks to our Business Watch sponsors.

Support Bridge's nonprofit civic journalism. Donate today.

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!