State again riding auto upswing

Nearly given up for dead a few years ago, Michigan’s automakers have come roaring back and are leading one of the strongest state economic recoveries in the nation.

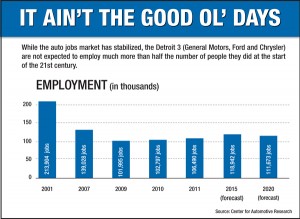

Today, General Motors Co., Ford Motor Co. and Chrysler LLC are churning out billions of dollars in profits and are hiring thousands of workers.

But we’ve seen this narrative before. The highly cyclical auto industry gives Michigan a few good years and then inflicts severe pain on the state in the inevitable next recession.

Will it be any different this time? Will Michigan again pay a steep price for its century-long love affair with the auto industry?

Those questions are worth considering because Michigan is in the fourth year of an economic recovery that seems to be losing some steam.

Michigan added 47,300 jobs last year after gaining 72,300 jobs in 2011. University of Michigan economists are predicting roughly the same number of jobs will be added this year as in 2012.

No one can predict exactly when the next recession will hit. Spiking energy prices, financial crises and other economic shocks that economists usually can’t forecast with any sort of precision have triggered recent downturns.

But some experts say Michigan’s restructured automakers are better positioned to weather an economic storm than they’ve been in decades.

They’ve trimmed excess production capacity, cut labor costs and are building top-quality cars and trucks.

Barring unforeseen events, the Detroit Three automakers could remain healthy for years, experts say.

“The domestic automakers are structured to break even with industry sales of 10 million or 11 million vehicles a year,” said Paul Traub, an economist at the Detroit branch of the Chicago Federal Reserve Bank. “So if sales stay at around the 15 million mark, they could do quite well for a number of years.”

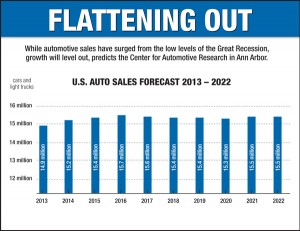

And that’s just what many are forecasting. U.S. auto sales are expected to run between 14.9 million and 15.7 million vehicles annually through 2022, according the Center for Automotive Research in Ann Arbor.

Others are more optimistic. R.L. Polk & Co. recently predicted U.S. auto sales would reach 16 million vehicles by 2015. Automakers haven’t sold that many vehicles in the United States since 2007.

Household wealth is growing again, giving consumers more money to buy new cars and trucks, according to CAR.

“Low interest rates on new-vehicle loans, along with record-high used car prices, also drive the new-car market to grow at a faster rate than the overall economy,” said Sean McAlinden, CAR’s chief economist.

Another reason consumers are buying more cars is that they’ve been hanging on to their old vehicles for so long that they’re wearing out.

The average age of cars and light trucks last year was a record 10.8 years, according to R.L. Polk.

That’s created a huge pent-up demand for new vehicles, which Traub estimated at about 2 million new cars and trucks likely to be purchased over the next several years.

Auto manufacturing and parts output in Michigan fell from 7 percent of state gross domestic product in 2001 to 4.2 percent in 2010, according to the latest federal data.

But experts say the industry likely has since recovered to at least its share of the state economy in 2001.

And by that measure, Michigan’s economy hasn’t diversified much over the past decade.

While some experts say Michigan will lag the nation in prosperity because of a lack of knowledge-industry jobs, George Erickcek, a senior regional economist at the Upjohn Institute for Employment Research in Kalamazoo, said putting so many eggs in the auto industry’s basket isn’t such a bad thing.

“This is a really wonderful basket,” he said. “It has high-skilled jobs and it makes a product that is not going away. I think it’s going to be a long time before you and I decide we want to travel solely by mass transit.”

States covet auto and manufacturing jobs, in part, because of their ability to create jobs in other areas. The spin-off effect of a manufacturing job ranges from three to seven additional jobs, depending on the type of manufacturing.

A service job typically creates only about seven-tenths of an additional job, Erickcek said.

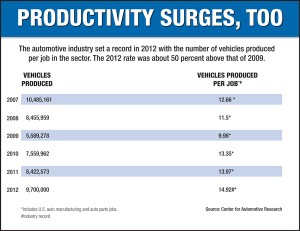

But job growth in the auto industry has been suppressed because of strong productivity, a trend some experts say is likely to continue.

In 2009, U.S. automakers and parts manufacturers produced 9.98 vehicles per worker, according to CAR. By last year, that they were producing a record 14.92 vehicles per worker.

Nevertheless, Erickcek said he sees Michigan continuing to be inextricably linked to the auto industry.

“Let’s be honest about it,” he said. “The state of Michigan has been designed to build cars. It’s still a big industry that we don’t want to give up.”

Rick Haglund has had a distinguished career covering Michigan business, economics and government at newspapers throughout the state. Most recently, at Booth Newspapers he wrote a statewide business column and was one of only three such columnists in Michigan. He also covered the auto industry and Michigan’s economy extensively.

Previous coverage

What's up, who's down in state economy?

Mapping Michigan's growth in 2011

How did your city's economy do in 2011?

Business Watch

Covering the intersection of business and policy, and informing Michigan employers and workers on the long road back from coronavirus.

- About Business Watch

- Subscribe

- Share tips and questions with Bridge Business Editor Paula Gardner

Thanks to our Business Watch sponsors.

Support Bridge's nonprofit civic journalism. Donate today.

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!

CLICK TO ENLARGE

CLICK TO ENLARGE CLICK TO ENLARGE

CLICK TO ENLARGE CLICK TO ENLARGE

CLICK TO ENLARGE