Opinion | Legal cannabis workers and businesses deserve banking fairness

Imagine you’re an entrepreneur interested in opening a business. Despite plans to hire dozens of employees and support your community, you are denied typical construction loans and lines of credit from institutions that use federal products or are backed by the federal government — which is nearly all of them.

Or, imagine, you’ve got a job you enjoy in a growth sector striving to provide a stable middle-class life for your family. You decide to buy a house — only to be denied a mortgage.

The reason for these denials: You work in the cannabis industry.

That’s because the federal government still regards marijuana as a Schedule 1 narcotic, preventing nationally-backed financial institutions from conducting normal business with Michigan cannabis companies or their employees.

But today’s cannabis landscape in Michigan and across the country looks far different than it did a few years ago — becoming legalized medically in 2008 and recreationally for adult-use in 2018 after voter referendums. A total of 38 states have decriminalized or legalized medical and/or adult-use cannabis now too.

The evolution and development of the cannabis industry requires thoughtful public policy that balances the interest of public safety, employers and employees while fairly regulating activities and addressing the needs of this burgeoning sector of Michigan’s economy.

That includes ensuring that cannabis business owners and workers have access to the same banking, borrowing and lending options as all other legal industries do.

That’s unfortunately not the case today. It’s time to change that and for Congress to pass the U.S. Secure and Fair Enforcement (SAFE) Banking Act.

The SAFE Banking Act will:

· Ensure that states like Michigan with legalized cannabis can act to properly regulate the industry within its state lines.

· Support Michigan’s $3 billion-plus cannabis industry and importantly, help business owners, workers and their families secure access to basic financial tools and security.

· Help protect cannabis businesses from being susceptible to theft and fraud, or even violent crime, by accounting for funds properly rather than as cash only.

· Address inequities in the cannabis industry, which in Michigan is on track to continue growing in the years ahead. The Great Lakes State currently ranks third in total state cannabis industry employment, with 32,819 employees as of July 31, according to Michigan Cannabis Regulatory Agency data. These jobs are likely to continue growing as more municipalities opt-in to allow cannabis businesses and the state continues to ramp-up enforcement of the illicit market.

The Act does not legalize cannabis on a federal level and doesn’t touch its Schedule I status. It simply ensures that financial institutions cannot be penalized for providing legal, regulated cannabis companies and their employees with banking and other financial services.

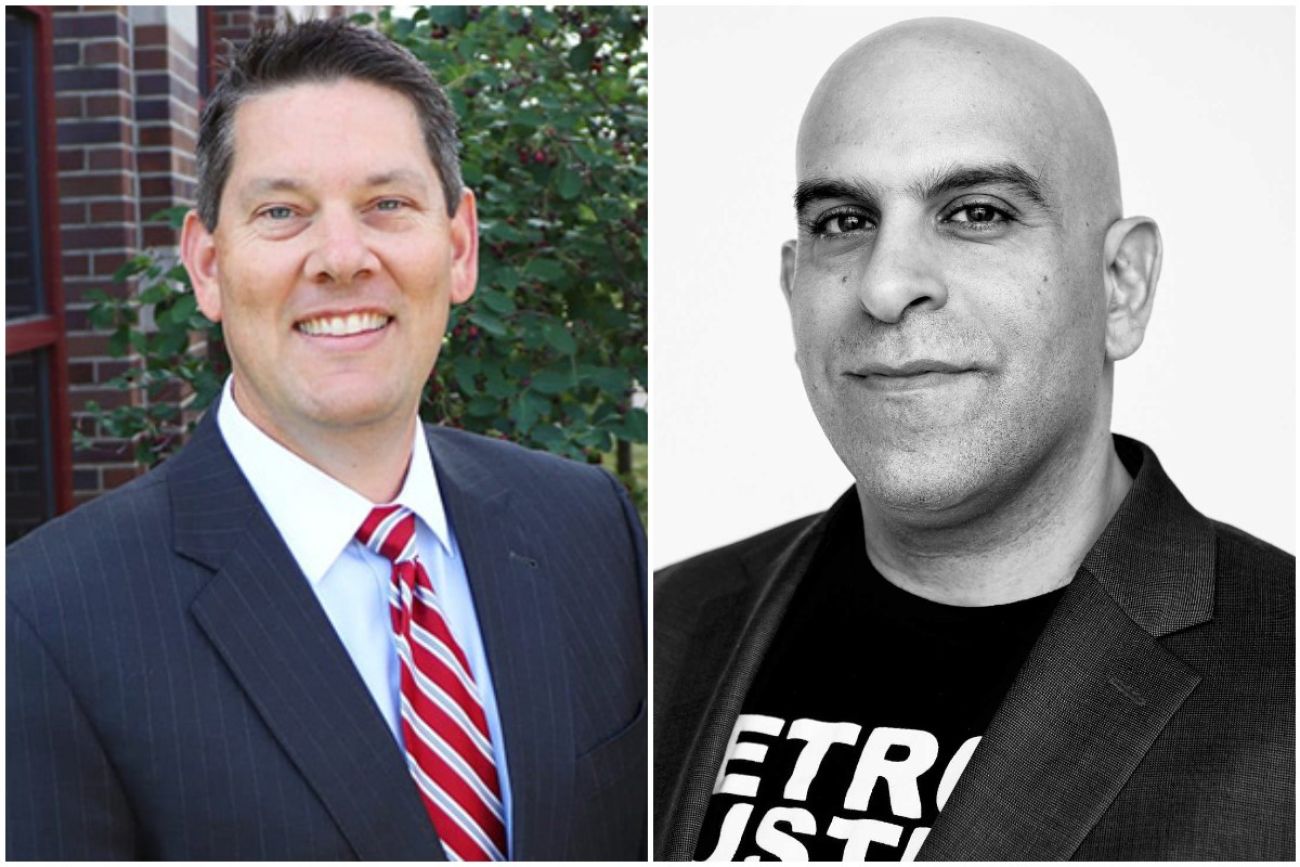

We call on Michigan’s congressional delegation to lead the way for every state with legal cannabis and pass the SAFE Banking Act without delay. It will provide stronger business and consumer protections while ensuring fair and equitable access to the financial services the rest of us use in our daily lives — all while making sure our communities stay safe.

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!