Opinion | You’re paying less taxes than you think. And that’s a problem.

How much federal income taxes do you pay?

The answer is probably less than you think, and that can lead to some bad policy decisions.

Let us explain:

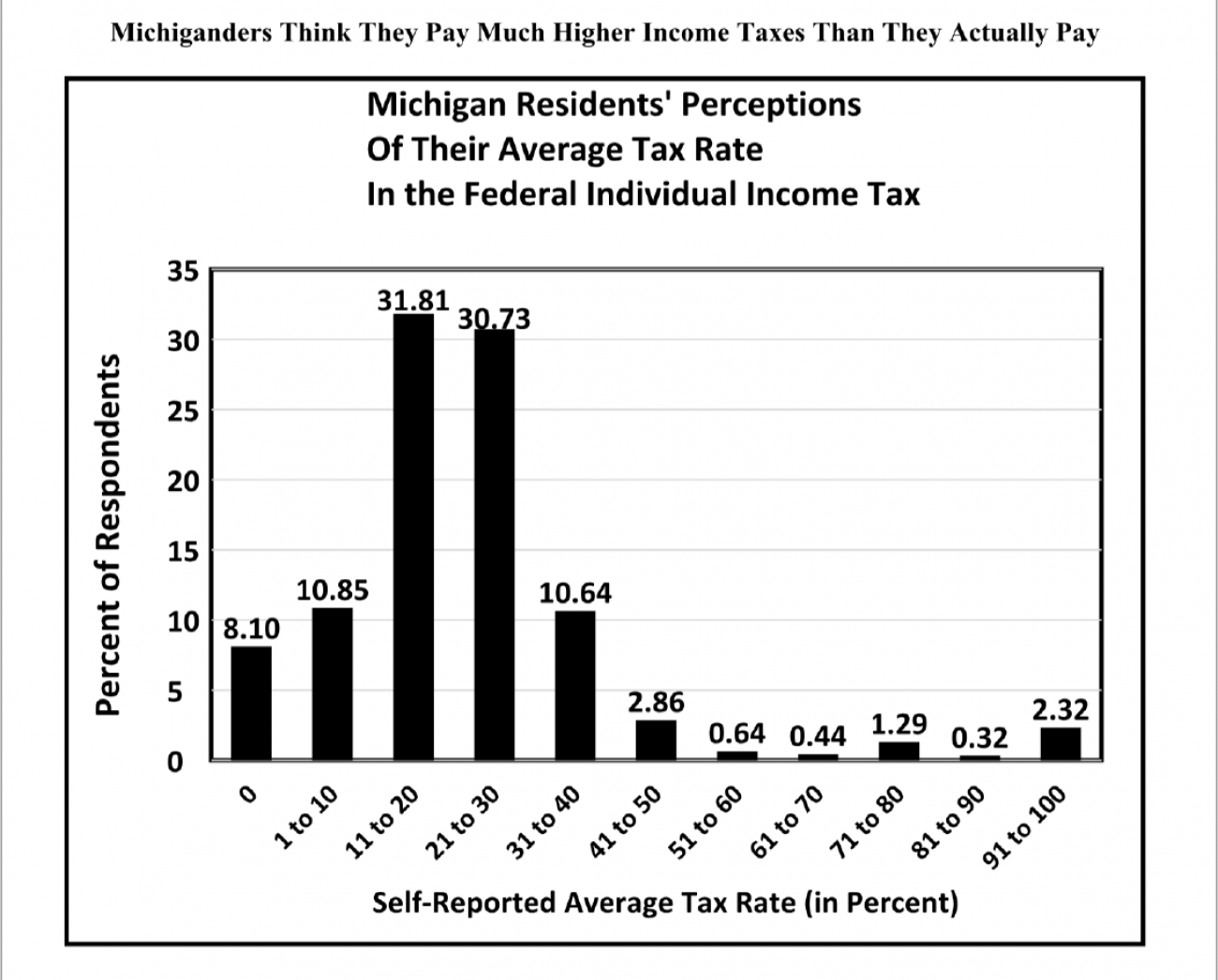

We asked Michigan residents how much of their income they think they pay in federal income taxes. The answers were eye-popping—the vast majority think they pay higher taxes than they actually pay, and some of the overstatements are huge. As shown in the graph, nearly 8 percent of the respondents to our survey said that they believe their average federal income-tax rate is 50 percent or higher. More than 2 percent said they think that all of their household income goes to federal income taxes!

The Institute for Public Policy and Social Research at Michigan State University found that about 85 percent of Michiganders think they pay more in federal income taxes than they actually do. We estimate that the actual average federal income-tax rate for this sample is about 13.9 percent, whereas they reported in our survey their tax rate to be about 25.5 percent, on average. Thus, on average, the respondents to our survey think they pay almost twice as much as they actually pay.

This is a serious problem. If people don’t know the basic facts about the tax system, they could easily be misled into supporting policies that are against their interests. In particular, our results suggest that political support for last year’s tax cuts may have been based partly on inaccurate perceptions of the tax system.

Indeed, we found that those who believe federal income taxes on households like theirs should be lower tend to overstate their income-tax rate by more. All else equal, a respondent who says the taxes on households like hers should be much lower than they are now would overstate the average income-tax rate by about 10 percentage points more than one who says that such taxes should be much higher than they are now.

Those who believe federal tax dollars are spent very ineffectively also tend to overstate their taxes by more, as do those who use tax-preparation assistance.

In research that is similar to ours, Joel Slemrod of the University of Michigan found that about half of Americans believe that most families have to pay the estate tax, whereas only a tiny fraction actually pay any estate tax. Slemrod’s results suggest that misconceptions about the estate tax explain some of the support for eliminating it.

The tax system isn’t the only thing about which the American public is misinformed. Surveys have found a substantial lack of knowledge of monetary policy, budget deficits, and other important economic phenomena.

Many studies have shown that Americans drastically overstate the size of minority populations. There is reason to believe that these misperceptions have contributed to today’s widespread xenophobia and anti-immigrant sentiment.

A study by the Kaiser Family Foundation found that the average American believes that 28 percent of the federal budget is spent on foreign aid, whereas the correct figure is about 1 percent! Thus many people appear to believe that it would be easy to eliminate the federal budget deficit without raising taxes or cutting popular programs like Social Security and Medicare.

We believe that our American democracy, like any democracy, will work better when the public is well-informed. We believe that more resources should be committed to civic education.

Also, there’s enough misinformation out there already, without spreading even more misinformation. This means that it’s especially important for public officials to refrain from spreading misinformation. When they do, it’s vital for the news media to set the record straight.

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!