College costs have doubled, even after inflation, and other frightening facts (Chapter 1)

Paying for college didn’t seem so hard back when Laura Phillips was in school. She took classes at Michigan State University for two years and the University of Michigan for another year and a half. Working part-time at various times at a Pizza Hut and a hotel, she graduated in 1991 with a bachelor’s degree in 3½ years and zero debt.

Twenty-four years later, Phillips’ son, Jordan, is a sophomore at Oakland University. He lives with his parents in their Rochester home north of Detroit rather than in the dorms to save money. Yet his family is paying at least twice as much for his education as it cost his mother.

“I lived on campus and he’s living at home, and I feel bad that he’s not getting the full college experience,” said Laura Phillips. “We’re middle class … (but) it’s just not feasible.”

Their experience underscores the struggles of many Michigan families to pay for – and comprehend the remarkable rise in – college costs. Parents of today’s college students commonly graduated college with no debt, often able to pay tuition bills by delivering pizzas on weekends.

That’s virtually impossible today.

As families across Michigan scramble to fill out federal college student aid forms by a March 1 deadline, here are the facts: A college degree costs more than double what it did a generation ago, even after taking inflation into account. It takes a much bigger share of your paycheck. It costs even more because you live in Michigan than most other states. Moreover, costs are rising faster for the poor than for the rich, and student debt has ballooned 56 percent just since 2005.

“It’s hard to know that so many of these kids are starting life so far in debt, where they’re paying student loans of $700 or $800 a month” said Laura Phillips. “That was twice my rent when I graduated from college.”

Roughly four-in-five Michigan residents say that improving college affordability is an urgent priority for Michigan. according to statewide community conversations and polls conducted by the nonprofit Center for Michigan, which operates Bridge Magazine.

To understand why there’s such an urgent need, consider these six realities:

#1 College is much more expensive for today’s students than it was for their parents.

The cost of a four-year college degree has more than doubled in a generation, even when taking inflation into account. The average sticker price of a year of tuition, fees, room and board at a public university in the U.S. was $7,938 in 1975 (when adjusted to 2014 dollars). By 2014, the cost had ballooned to $18,943. That’s a 138 percent increase.

The cost at private colleges jumped even more. The median sticker price of tuition, fees, room and board at private institutions in 1975 was $16,475 (in 2014 dollars); in 2014, it was $42,419 – a 157 percent increase.

By comparison, over that same time period, the median price of a newly constructed home increased 72 percent. The average price of a new car increased 92 percent.

Meanwhile, the median income in the U.S. between 1975 and 2013 (the latest year available) increased, when adjusted for inflation, just 1.6 percent.

“I suspected that was going on,” said a frustrated Laura Phillips. “It certainly seems more expensive.”

#2 Even when grants and scholarships are included, college costs are breaking the budgets of middle-class families.

Most families don’t pay the full sticker price for college. Grants and scholarships from federal and state government and universities themselves cut the cost for low- and moderate-income households. But even with that aid, the financial burden of college is growing – particularly in Michigan.

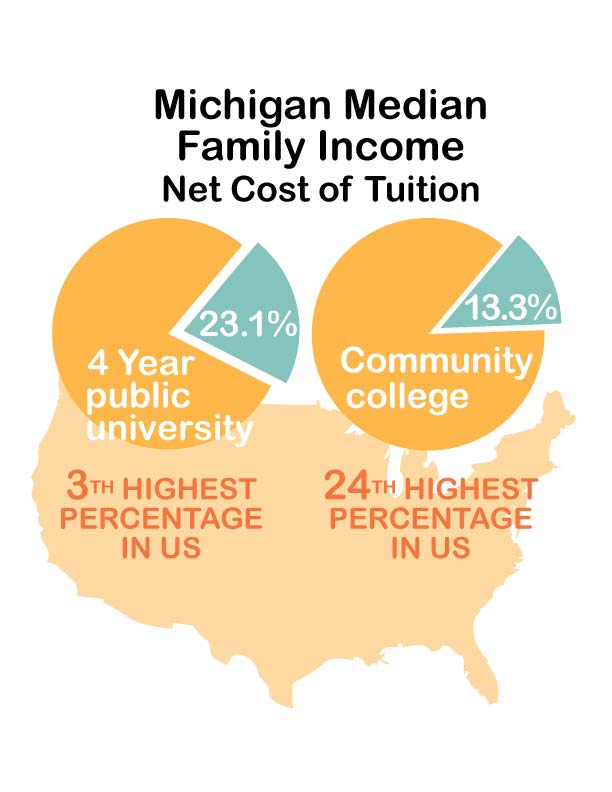

In the 2006-07 school year, the first year for which data is available, the net cost of attending a Michigan public university ate up 17.4 percent of the Michigan median household income – the ninth-highest burden in the nation. By 2011-12, the latest year data is available, the annual net cost represented 23.1 percent of the Michigan median household income – third highest in the country.

#3 College is more expensive in Michigan than in most states.

Most American families can send their children to their state’s public universities for less money than Michigan residents have to pay.

The Integrated Postsecondary Education Data System (IPEDS) a college data bank for the federal government, tracks net costs of attendance (tuition, fees, room and board minus grants and scholarships) at U.S. colleges. Bridge compared Michigan’s public universities to similar public universities around the nation (U-M Ann Arbor and MSU to other high-research public universities, for example), by using the Carnegie Classifications of Colleges, to provide an apples-to-apples comparison of costs across the country.

That analysis found the net cost at 12 of Michigan’s 15 public universities was higher than the median net cost at peer institutions around the country. (A Bridge analysis in 2012 found the same results)

Some examples:

- The University of Michigan at Ann Arbor had an average net price (after scholarships and grants are considered) of $15,939 in the 2012-13 school year, the latest year data is available. Two schools U-M is often compared to in national rankings are lower in cost – the University of Virginia at $13,463 average net cost per year and the University of North Carolina at Chapel Hill at $11,994 per year.

- Michigan State University, with a net cost of $14,526, is just above the national median for “very high research” public universities. A land-grant university MSU is often compared to, Purdue University, has a net cost of $13,541.

- Central Michigan University ($12,936) and Oakland University ($12,713) are both about $1,000 a year above the national median net price for similar public universities. Grand Valley State University, at $15,664 average net price, costs $3,676 more per year than the median cost of schools in its college classification.

#4 It can be even worse for low-income families, despite need-based financial aid.

For low-income families, the financial burden can be overwhelming. For example, a recent Bridge Magazine analysis found that the average Michigan family earning just under $30,000 a year would have to pay 46 percent of their annual earnings to pay the net price at Western Michigan University; that same family would pay 38 percent of annual earnings at Saginaw Valley State University; 35 percent at Wayne State University.

#5 Paying for full-time college with a part-time job is virtually impossible today.

Take as an example a student trying to pay the net cost of $15,939 a year for attending U-M in Ann Arbor. If that student could pick up a job waiting tables or working as a lab assistant on campus that paid $10 an hour, even if that paycheck was tax-free, the student would need to work 30 hours a week every week of the year just to cover his or her college bill.

#6 The result: students going deeper in debt

Today, more students are going deeper into debt. In Michigan, the average college student who takes out student loans graduates with $29,583 in student loan debt – a figure that has jumped 56 percent since 2005 as incomes have stagnated and tuition has continued to rise. Michigan students rank 8th in the nation in student debt burden (they ranked 18th in 2005).

Ferris State grads leave campus with the highest average debt among Michigan public universities, at $37,325, and Wayne State the lowest, at $23,136. Lawrence Technological University grads had the highest debt burden among the state’s private colleges, at $42,044.

That’s a far different world than when Laura Phillips went to college.

Her father, working one job, was able to pay for five children to attend college. “He said he’d pay for tuition and if we wanted to live in the dorms, we’d have to get a job,” Phillips recalled. Even paying tuition for that many kids seems unimaginable today to Phillips, who has two children.

“I just want to go give my dad a hug and ask, ‘How did you do it?’”

Michigan Education Watch

Michigan Education Watch is made possible by generous financial support from:

Subscribe to Michigan Education Watch

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!

Jordan Phillips, left, and mother Laura Phillips of Rochester are learning first-hand how higher education economics have changed since Laura got her degree in 1991. (Courtesy photo)

Jordan Phillips, left, and mother Laura Phillips of Rochester are learning first-hand how higher education economics have changed since Laura got her degree in 1991. (Courtesy photo) Source: National Center for Higher Education Management Systems

Source: National Center for Higher Education Management Systems