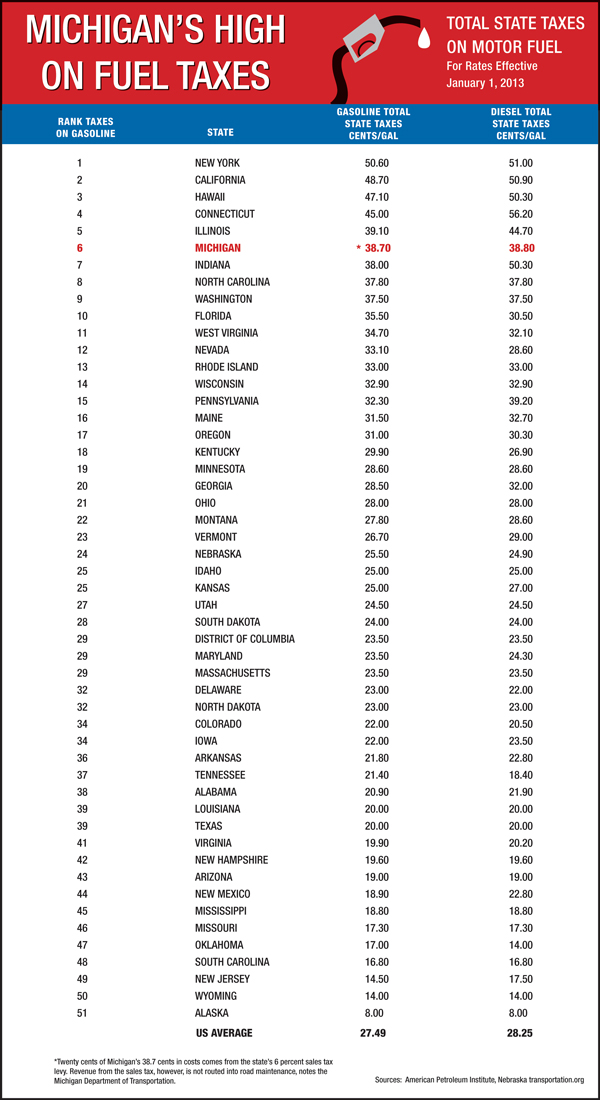

Michigan's current fuel taxes place it in the national top 10

Michigan last raised its fuel taxes in 1997, moving it from 15 cents to 19 cents (technically 18.715) for gasoline. In the interim, the buying power of those 19 cents -- for asphalt, steel and the other elements of road construction and repair -- has eroded. The nonpartisan Citizens Research Council noted in a 2011 report that had the 19-cent levy kept pace with inflation, it would now be 27 cents.

In addition to this direct fuel levy on a gallon of gas, Michigan also imposes a 6 percent sales tax on the fuel (and on the federal 18.4 percent fuel tax). The figure in the ranking below reflects total state taxation on fuel, not just the direct per-gallon levy.

Proposals under consideration at the State Capitol center on shifting from a retail fuel tax to a wholesale one, raising registration fees or adding 2 cents to the sales tax to allow for elimination of the fuel tax.

Business Watch

Covering the intersection of business and policy, and informing Michigan employers and workers on the long road back from coronavirus.

- About Business Watch

- Subscribe

- Share tips and questions with Bridge Business Editor Paula Gardner

Thanks to our Business Watch sponsors.

Support Bridge's nonprofit civic journalism. Donate today.

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!